Meeting a Milestone: US 2012 Consumer Electronics Market to Hit $200B

According to the Consumer Electronics Association, the US Consumer Electronics industry will reach a milestone of $206 billion in 2012.

This will be an increase of 5.9%, followed by 4.5% in 2013, when we anticipate sales of $215.8B. CE.org’s definition of consumer products includes more products in its definition than some industry researchers do; others reporting phone and PC sales in the telecom and computer category. But that is OK. The fact is, there has been a monumental convergence between the “3 Cs” (computing, communication, and consumer electronics) during the past decade.

- CE says tablet sales will reach $29.1 billion, $10 billion more than projected in January, for an 83% YOY growth and 83 million units.

- Smartphone sales will also increase dramatically to $33.7B. The 108 million units sold will represent an increase of 24%. These two categories alone more than explain the uptick in CE sales for 2012-13.

- Notebook PCs will reach $14.9 billion, with 21.3M units sold. Interestingly, the tablet category is less than four years old, but will still record sales four times the number of notebooks here — even though notebooks added a major new product in 2012, the Ultrabook.

- The $206 billion figure encompasses the 90% or so of CE manufacturing that is offshore.

Insourcing/Re-Shoring of CE Products

These figures are consumption, not production, which remains solidly offshore. However, the organization has identified a shift, albeit embryonic at this time, to manufacture in North America for NA regional consumption — or by NA-based manufacturers. Reasons for this shift are many, not the least of which is increasing costs in China. Here are some reasons for “inshoring” of production to North America:

- Costs in China are rising rapidly — up to 40% per year or more, with an increasingly unstable workforce.

- Supply chain costs in China include higher minimum order quantities (MOQ), long lead times, and increasing prices.

- Employing a hybrid approach: Making products in both places, depending on demand and lead times.

- Productivity of North American workers is higher — up to three times per hour of Chinese workers.

- Automation is higher here than in China, as is our ability to design and build automated facilities.

- Maintaining control in China with resident ex-pats is expensive.

- Logistics, including shipping, time-to-market, and duties, make for a difficult-to-manage supply chain.

- Product quality control is enhanced with tighter management of the manufacturing process.

- Exposure to volatility in China as more socio-political issues and potential conflicts come to light.

- “Made-in-America” is gaining popularity, with increasing resistance to massive offshoring.

- Ditto for the US, as expectations increase for an energy-independent nation.

- Recent economic resurgence in Canada due to energy production, lower taxes, and regulations.

- Innovation in North America remains at the top — in materials, product design, and in new technology.

You might say this recent uptick is a blip caused by improving market conditions. Others believe it is the start of a trend bucking a tepid recovery. Lest we get too optimistic, costs still remain much lower in China and the global supply chain is now an embedded fact of doing business for all but the smallest firms. There is also the undeniable fact that markets for CE products are growing fastest in the developing world. But if one acknowledges that you must manufacture there to gain significant market share, does the reverse also apply? One example is the TV industry, which years ago drifted from the US to Japan and eventually became a route to Southeast Asia and China. Household names such as Philco, Motorola, Zenith, and others disappeared. Along the way, however, a curious thing happened: The essentially captive CRT-tubed/Asian-centric TV went digital and adopted PC-like characteristics, including its HDTV design, supply chain, and flat panel displays. This opened up the market to many new startups — including some innovative North American designers. Companies like Vizio and Element have gained traction with US-designed products and low corporate costs. Today Vizio is the #1 seller of HDTVs in the US and Element is moving forward with large-screen TVs assembled in Michigan. According to CE.org, TRTL BOT of Los Angeles is recycling water bottles in a solar-powered factory. Each iPhone or iPad has at least one recycled bottle integrated into its case. There are numerous other cases where this type of thing is happening.

We’ve also noted GE’s $1 billion investment in domestic factories in the home appliance field. This is happening at a time when global competition is strong — and not only at the low end. Samsung and LG make some of the most expensive high-end refrigerators. GE is completing the first phase of a $150 million dishwasher manufacturing plant at its Appliance Park in Louisville, KY. Key component parts will be insourced to the US, said the firm. The dishwasher manufacturing investment is in addition to other projects, including moving hybrid water heater production back to the US, and new bottom-freezer refrigerators and front-load washers.

We’ve also noted GE’s $1 billion investment in domestic factories in the home appliance field. This is happening at a time when global competition is strong — and not only at the low end. Samsung and LG make some of the most expensive high-end refrigerators. GE is completing the first phase of a $150 million dishwasher manufacturing plant at its Appliance Park in Louisville, KY. Key component parts will be insourced to the US, said the firm. The dishwasher manufacturing investment is in addition to other projects, including moving hybrid water heater production back to the US, and new bottom-freezer refrigerators and front-load washers.

We will see in the coming years how much this progresses. Companies like Apple will have a lot to say about this as they become sensitive to public opinion about where products are being manufactured.

CE Industry Review

Here is a list of prominent CE products and the ups and downs that have become noticeable as cross-market competition increases:

HDTV. Connected TVs win; so far 3D does not. Samsung now leads the industry. Vizio is the US leader. Over-capacity has plagued the multi-billion-dollar panel business so that the price of large-screen TVs is coming down. 1Q12 revenue fell for the first time by 8%. HDMI reigns, along with component video. The trend is toward thinner panels with WiFi capability. Samsung is mastering AMOLED technology, which will eventually become the industry standard. However, costs are now eight to 10 times TFT-LCD. 2012’s LCD-TV forecast is for 216 million units, +5% YoY and 88% of total TV volume. Total TV production will decline -1.4%, to 245 million units. 2013 will be the last year for CRT, and LED-backlit TFT-LCDs will approach 100% of the market. Source: DisplaySearch.com

TV Market Shares

1Q12 industry market shares were as follows (Source: iSuppli):

- Samsung 19%

- LG 13%

- Sony 8%

- TCL 6%

- Toshiba 6%

- Others 48%

Mobile PCs

Tablet sales will surpass Notebooks in 2016. Total mobile computer shipments will increase from 347 million units in 2012 to 809 million units by 2017. Apple will remain #1 in tablets, while its share will decline to ~50%. Samsung is #2 and is also making a major run at UltraBooks. The jury is still out on how big UltraBook inroads will be. We believe the notebook category will merge and the ultra-thin design will become ubiquitous. That means prices will have to come down, but will still be higher than before UltraBooks came on the scene.

MSFT Surface Tablet et al

We think HP, Dell, Acer, and other traditional Wintel Notebook PC makers will introduce tablets based on Windows RT. And, that MSFT Surface entry is being introduced to plow a path for PC suppliers who use Windows, Internet Explorer, and Office, much like Google did with Android. The difficulty we have is, how this will impact notebook sales? The popular opinion is, it won’t. We think it will. It already did with the iPad. Surface is an attempt by MSFT to get up to speed with the tablet craze. But it will do so with business users in mind, walking a tightrope between tablets and PCs. We think the ideal user mix will be an iPad or Surface tablet for road warriors and a notebook or AIO desktop back in the office. There is also this confusing point: The iPad was designed as a handheld content-viewing appliance with little need for IO connectivity beyond WiFi and LTE. PCs were designed as an all-purpose laptop/desktop content creation machine that does everything. Now we are mixing the two. Wait and see. (Bishop’s PC Report is in the mill for fall 2012 delivery. It covers this).

Smartphones

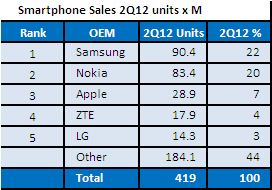

The global mobile phone market declined 2.3% to 419 million units in 2Q12 vs. 2Q11. The shift from cell phones to smartphones continued, with smartphone sales representing 64M of that total. Smartphones did continue to grow, + 43% YoY. Leading suppliers are included in the table at right. Nokia is in the #2 slot, even though they have lost considerable position outside of Europe to iOS5 and Android suppliers. Like in the tablet wars above, Nokia is hoping for a rebound with its Windows phones. Screen resolution and size are in the forefront with the next Samsung and Apple entries sporting 4.5” to 5.5” screens and Apple’s Retina display.

Apple’s successful $1B suit against Samsung throws a potential monkey wrench into the smartphone market. This may cause Google and others to retool designs – and could benefit MSFT’s entry with a totally new design. Longer term, look for new innovations in smartphone design and software from Apple competitors.

Digital Cameras and Camcorders

The DSC/DCC (digital smart camera/digital camcorder)market has been impacted by smartphone use of increasingly higher resolution cameras. So, within a decade of these cameras decimating film-camera use, they also face possible obsolescence. It took 100 years for the “film-switcheroo” to happen, and less than a decade for the “phoneroo” to occur. This is because of advances in CMOS image sensor technology, flash storage, and ultimate portability.

The DSC/DCC (digital smart camera/digital camcorder)market has been impacted by smartphone use of increasingly higher resolution cameras. So, within a decade of these cameras decimating film-camera use, they also face possible obsolescence. It took 100 years for the “film-switcheroo” to happen, and less than a decade for the “phoneroo” to occur. This is because of advances in CMOS image sensor technology, flash storage, and ultimate portability.

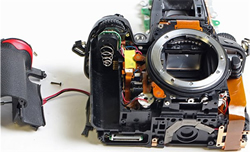

For those with amateur photography in their veins, DSCs are still important — particularly the new crop of DSLRs and digital micro-camcorders at dramatically lower prices. Here are examples:

GPS Receivers

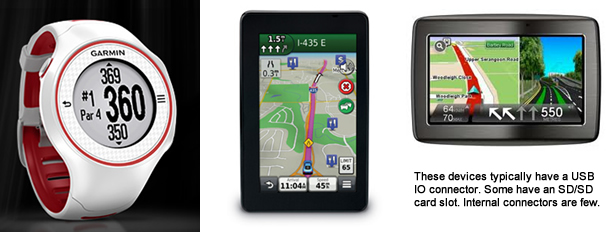

This is also a confusing picture. There are now three related technologies vying for the same application: PNDs (portable navigation devices), In-Dash GPS, i.e. original equipment, and smartphones. There is a fourth area for consumers and business: personal location devices. Arguably GPS technology is one of the most useful consumer developments of the past decade. Companies like Garman, Magellan, Tom-Tom, Pioneer, and others have developed ever-smaller and more powerful GPS receivers, aided by the latest nav technology: WAAS (Wide Area Augmentation System) with positioning accuracies to less than three meters and 3D capability enabled by locking onto five satellites. PNDs also have live traffic updates, weather alerts, lane-changing alerts, and 3D depictions of local intersections. Some can be connected to a backup camera and have Bluetooth phone syncing capability. In-dash systems are more powerful, but because of long design cycles in automotive, they may not have all the latest features. Smartphones are coming on strong, both with Google’s long-term dedication to Google Maps and Apple’s upcoming iOS6 real-time mapping and navigation features. We think PNDs will continue to be preferred by road-warriors, but many consumers will be satisfied with turn-by-turn voice prompts. Thus, the rapid growth of PNDs has slowed and could even decline in future years. Examples of PNDs are below:

Summary

There are thousands of CE devices, consumer appliances, and audio/video equipment on the market. They fall into different categories, vis-à-vis their electronic packaging and interconnect requirements. Some, like phones, tablets, and PCs (not shown), are digital crossovers to other equipment markets.

Audio equipment tends to be its own sub-market, with many specialist companies, like Bose, Klipsch, Marantz, Cambridge Audio, Peachtree, and others. This market caters to audio enthusiasts who are willing to pay big bucks to get the ultimate in sound equipment. RF/coax rules in this arena, in addition to SPDIF (Sony/Philips Digital Interconnect Format)/optical audio.

Video was the territory for Sony, Sharp, and Panasonic. But massive new competition has arrived with the digital/LCD/HDTV revolution. TV is now more like the PC market and its packaging is dominated by large flat-panel displays and IO connections.

In the not too distant future — timing depends on moves by threatened players — HDTV will shift to the WWW. We believe the logical path will be through connected TVs, but myriad portable devices will explode content availability just like it has on the Internet. This will threaten the pay-per-cable business model, and its forces are at work to find a beneficial outcome for them. Since all primary stakeholders in the industry depend on a revenue stream, from content creators to deliverers, expect to see CATV/satellite play a major continuing role. The networks will also be threatened and they don’t need any more competition. We will see how this all plays out. In any event, expect to see more and more free content over the Internet and a major role for tablets and HDTV.

Key players:

| Apple | Vizio | Comcast/NBC-Universl |

| AT&T | FCC | |

| Intel | Verizon | IEEE 802ac/Other Wireless/YouTub |

| Microsoft | Fox | HDMI.org |

| Samsung | ABC | Amazon.com |

| Sony | CBS | Netflix |

The Wall Street Journal reports Apple may be in discussions to provide a new type of set top box. This would allow Apple to work with the content delivery industry, (cable/satellite) on a new Apple TV. Alternatively, the highly creative Apple could apply its extensive hardware, software, and apps capability to develop new iTunes video à la carte offerings, teaming up with content producers. The plot will thicken with profound implications for the hardware industry.

|

John MacWilliams Senior Consultant and Analyst, Bishop & Associates Inc. John has enjoyed a long and diverse career in the electronics industry, including management positions with IRC, TRW, AMP, and his own company, US Competitors LLC. He is the author of many industry articles, including past and current iNEMI.org connector industry roadmaps, U.S. government competitiveness initiatives, and numerous Bishop Reports on the computer and consumer electronics industries. He is an outspoken supporter of the future of U.S. manufacturing in a global marketplace.John is a graduate of the Wm. Penn Charter School in Philadelphia, and of Lehigh University, Bethlehem, PA. He and his wife Louise, reside in Newark, DE, and Delray Beach, FL |

- Electric Vehicles Move into the Mainstream with New EV Battery Technologies - September 7, 2021

- The Dynamic Server Market Reflects Ongoing Innovation in Computing - June 1, 2021

- The Electronics Industry Starts to Ease Out of China - November 3, 2020