Wrap-Up: Mixed Feelings at electronica 2012

Wrap-Up: Mixed Feelings at electronica 2012

The global connector market is in negative territory compared to last year, with global sales down by 5% at the end of September (YTD). This is particularly true in Europe, where sales have decreased by more than 12% versus 2011 (September, YTD) and the lack of transparency is characteristic of current market conditions. So naturally, the industry is looking for direction and some positive news. The electronica exhibition, held every two years in Munich, is probably one of the best events to gain a good general overview of the connector industry leaders’ perception of the state of the electronics and connector industries at present, and to get a feel for what lies ahead.

The general consensus among connector manufacturers appears to indicate that 2013 will be a year with limited, single-digit growth for the global connector market but with good growth opportunities in specific niches. There are thus far no signs that imply that 2013 will be a “negative” year, but as we all know by now, market volatility has increased dramatically over the past decade, and the highs and lows tend to be more extreme than in the past. As much as we identify some downside risks to the market, there are also opportunities that would fuel an upswing.

Downside risks for the global connector market include:

Downside risks for the global connector market include:

- The European euro and sovereign debt crisis remains unsolved

- The US fiscal cliff issues remains unsolved

- New Chinese leadership has set a new course for China

- Trouble in the Middle East is escalating

Once a positive and lasting answer is found for one or more of these risks, an upswing in the market is also possible. If the European euro/debt crisis is resolved; the US agrees on ways to avoid or deal with the fiscal cliff and deficit; the Chinese leadership launches a long-term growth plan for the Chinese economy; and the issues that trouble the Middle East remain under control; the global economic outlook will improve dramatically. But there are additional upside opportunities to be found in the marketplace, too.

Market Opportunities

The rollout of 4G (LTE, WiMAX) technologies in the telecom markets will be accompanied by new infrastructure (small cell and carrier WiFi) and new handsets to make full use of this technology. 4G-equipment growth may not offset a decline in 2G/3G equipment, but suppliers that are well positioned in this new growth segment will benefit.

The rollout of 4G (LTE, WiMAX) technologies in the telecom markets will be accompanied by new infrastructure (small cell and carrier WiFi) and new handsets to make full use of this technology. 4G-equipment growth may not offset a decline in 2G/3G equipment, but suppliers that are well positioned in this new growth segment will benefit.

Computer sales are in decline (Q3-2012) for the first time in two decades, but tablet sales are booming, offering strong growth opportunities for connector manufacturers that have or gain a market share in the tablet market.

The infrastructure for EV (Electric Vehicles) is being rolled-out in many developed countries, even though the sales of EVs still lag. We may reach a tipping point at some time ahead where EV sales may accelerate.

The infrastructure for EV (Electric Vehicles) is being rolled-out in many developed countries, even though the sales of EVs still lag. We may reach a tipping point at some time ahead where EV sales may accelerate.

Automotive markets are also in motion. Where production volumes seem to have gone beyond saturation levels in developed countries, the markets for premium brands remain strong and exports to developing countries to new upper middle classes promise to keep volumes increasing. Volume production will have to be reduced in developed countries, while production volumes of affordable cars in developing countries continue to grow and largely serve domestic (local) markets. Concurrently, the electronics content per vehicle is still growing.

Energy markets are developing fast and new opportunities present themselves continuously as smart grid energy (power) networks (must) become more efficient. Improvements are underway for the control mechanisms that manage the power and energy distribution from substation to end user. China has invested huge sums in their smart grid power networks and may overtake the US in less than five years as the leader in total electric power generation capacity. With the explosive growth of both its energy needs and its smart grid power networks, China is poised to lead the way in energy distribution automation.

In December 2011, German electronics giant Siemens bought eMeter, a San Mateo-based startup focusing on smart grid technologies for utilities such as power and water. In October 2012, Siemens announced its intent to sell off its solar energy division. Both decisions by Siemens are a good illustration of the dynamics in the energy markets.

While the industrial market is slowing and is currently in negative territory, this particular market is so diverse that there are still plenty of niches in which connector manufacturers achieve sales growth. Increased use of fiber optic products on the factory floor and in harsh environments, even outdoors, also offers ample opportunity for connector manufacturers.

Semiconductor Market Outlook

Global 2012 YTD semiconductor sales (up to September) were down 4.7% compared to the same time last year, very close to the 5% decrease recorded for the YTD connector industry by Bishop & Associates. For the full year 2012, experts expect a decline of 2.5% to 2.6% compared to 2011 for semiconductor sales. 3Q 2012 sales results of global electronics distributors such as Avnet and Arrow appear to confirm these numbers. Bishop & Associates’ forecast for the full year 2012 is again very close to the semiconductor number, with -2.6% versus 2011.

What is the outlook for 2013? The overall economic outlook is uncertain, which, combined with a lack of transparency, is reflected in the forecasts provided for the semiconductor market in 2013 by various market experts/organizations. These forecasts range from +1.5% to +9% for 2013 versus 2012. In any case, the outlook is in single-digit positive territory and relevant for the connector market, as there is empirical evidence of a correlation between trends in semiconductor and connector sales in many large end-use equipment markets.

Regional GDP and Macroeconomic Outlook

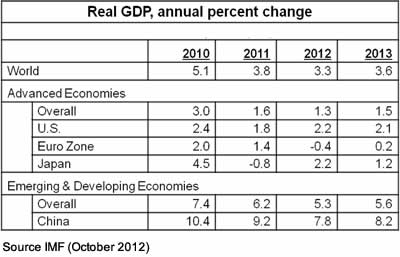

The latest forecast from the International Monetary Fund (IMF) indicates a worldwide GDP growth of 3.6% in 2013, a small improvement from 3.3% in 2012. According to the IMF, the euro zone may begin a slow recovery from the downturn caused by the debt crisis. The IMF also expects growth in the US to slow down to 2.1% in 2013 versus 2.2% this year. Emerging and developing economies will be the major growth drivers for the world economy, with 5.6% growth in 2013. China’s GDP growth should accelerate slightly in 2013, after slowing in the past two years.

Connector market performance is obviously linked to overall GDP growth, and more specifically to growth in industrial production. The slightly improved GDP growth figures for 2013 compared to 2012, may therefore signal a fragile recovery of the connector market in the lower single digits.

Connector Market Outlook and 2013 Forecast

When trying to gauge the general business sentiment at electronica, the mood could probably be best described as “cautiously optimistic” for the global connector markets with “growth opportunities in niche markets.” Some markets are clearly suffering, such as the solar energy markets. This sector has been taking a huge hit in the past year, and connector sales to the industry were virtually decimated, measured in US dollars. Other niche markets, as described above, offer opportunities and sometimes one needs a bit of luck to be active in a niche that suddenly takes off. Other manufacturers develop a keen sense for detecting these growth niches and their performance appears unaffected by the 2012 market downturn.

On the basis of this mixed input, Bishop & Associates developed a forecast for the global connector market for 2013. In our view, the market will grow in the lower single digits, with a midpoint at 4.2% growth over 2012. If you would like to receive more detailed information on the outlook for the connector market in 2013 with a five-year forecast until 2017, watch for our upcoming Connector Market Forecast report, which will be published in early December.

Epilogue: Munich’s biggest power outage in two decades brings city to halt

We end this article on electronica 2012 with a little anecdote about the power outage we experienced during the show in Munich.

Our reliance on electrical power and the importance of a reliable and efficient electricity network was perfectly illustrated when on Thursday, November 15, a power outage caused temporary chaos in Munich and left 450,000 households without electricity. Many of us visitors to the electronica show were caught unaware in the shower, while shaving, or trying to catch a train to the fairgrounds, only to find out the trains weren’t running! Even the taxi dispatch could not be reached.

Luckily for the visitors to electronica and most Bavarian households, the German authorities solved the problem very quickly and Thursday eventually turned out to be another good day at electronica!

- The Industrial Market for Connectors in a Changing World - April 20, 2021

- How Key Trends in the Transportation Market Will Impact Electronics Growth - March 17, 2020

- Automation Means a Bright Forecast for Industrial Connectors - February 19, 2019