A Global Medical Market in Flux

Aging populations, wireless devices, the ACA, and budget cuts put the global medical market in flux.

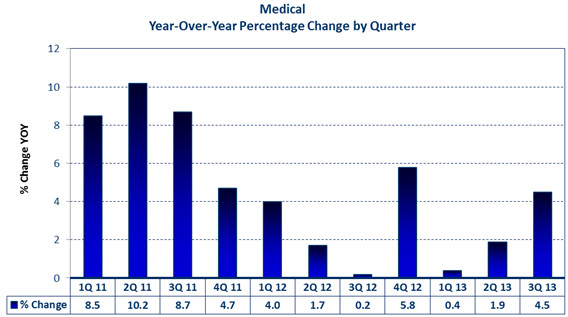

Bishop tracks eight companies in the medical market sector. Growth in the medical market, as measured by these eight companies, has been relatively good in the last two years, with year-over-year growth of 8.0% in 2011 and 2.9% in 2012. In the first three quarters of 2013, these companies’ sales grew 2.2% year over year. 1Q13 grew 0.4%, 2Q13 increased 1.9% year over year, and third quarter increased 4.5%. In comparison, the cable assembly market for the worldwide medical market sector grew 6.1% year over year in 2011, contracted 4.9% in 2012, and grew 0.3% in 2013. Trends in the global medical cable assembly market vary greatly by region, as they are significantly impacted by individual governments, policies, and budgets, putting the global medical market in flux.

Bishop tracks eight companies in the medical market sector. Growth in the medical market, as measured by these eight companies, has been relatively good in the last two years, with year-over-year growth of 8.0% in 2011 and 2.9% in 2012. In the first three quarters of 2013, these companies’ sales grew 2.2% year over year. 1Q13 grew 0.4%, 2Q13 increased 1.9% year over year, and third quarter increased 4.5%. In comparison, the cable assembly market for the worldwide medical market sector grew 6.1% year over year in 2011, contracted 4.9% in 2012, and grew 0.3% in 2013. Trends in the global medical cable assembly market vary greatly by region, as they are significantly impacted by individual governments, policies, and budgets, putting the global medical market in flux.

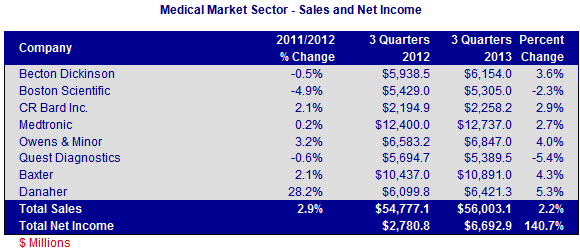

Bishop follows electronic interconnects sales trends in 13 markets. The combined annual revenue of all the market sectors was $4.3 trillion in 2012 and grew 4.9% over 2011. Of the 13 market sectors, medical was the seventh-fastest growing market sector in 2012, at 2.9% year over year with combined revenues of $73.6 billion. Profitability was $5.5 billion at 7.5% of sales, making it one of the more profitable sectors.

For the first three quarters of 2013, Danaher had the largest increase in sales, at 5.3% year over year. Much of Danaher’s growth in 2012 was due to the acquisition of Beckman Coulter in 2011. Danaher’s 2013 growth is more organic in nature, as it benefits from this and other past acquisitions.

Baxter, the second-largest company on our list, has the second-highest growth in the first three quarters, with sales up 4.3% year over year. Q3 sales for Baxter were up 9% overall, with biosciences up 6% and medical products up 10%. Baxter generated 43.5% of its revenue in the United States and 56.5% abroad in the third quarter.

Owens & Minor grew 4.0% in the first three quarters of 2013 over 2012. The company is a major distributor of medical products and devices.

Becton Dickinson’s sales increased 3.6% in the first three quarters (year over year: 0.5% in Q1, 3.6% in Q2, and 6.8% in Q3). BD is a leading provider of medical products for medication delivery, blood collection, diagnostic testing, flow cytometry, infusion therapy, surgery, anesthesia delivery, ophthalmology, critical care, immunization, sharps disposal, and medication management. BD’s sales are 42% in the United States and 58% international. Its emerging markets sales grew 13% in Q3.

Medtronic, the largest company on our list, grew 2.7% in the first three quarters of 2013. The company has several business sectors that have all performed in the mid-single-digit range in 2013 for sales growth (the market average). 45% of the company’s sales are international.

Quest Diagnostics contracted 5.4% in the first three quarters of 2013. The company’s president said that “healthcare utilization and reimbursement continue to be a headwind for our industry, and our results reflect that.”

The following table shows the results for the eight companies we track in this market sector.

As shown in the following chart, year-over-year sales have grown in each of the last 11 quarters. Sequentially, third quarter 2013 sales increased 1.0% from the second quarter of 2013.

- The medical electronics market has seen significant changes in the last few years. Changes in Medicare reimbursement schedules and the Affordable Care Act are adversely impacting the profitability of the healthcare industry in the United States; thus, the healthcare industry is buying less equipment. Government budget cuts in Europe are having a similar impact. Because of this, we expect worldwide growth to remain muted in 2014 for cable assemblies.

- Medical equipment manufacturers are bearing the cost of a 2.3% excise tax on their equipment, which is driving up their costs.

- The uncertainties of when and how the act will be implemented has caused healthcare providers to be very cautious about spending money for equipment.

- The healthcare reforms are driving many private practitioners out of business because they cannot compete with the larger providers; thus, fewer offices are buying equipment.

- The use of I/O cable assemblies in medical electronics is diminishing, as many devices are adopting wireless connectivity.

- Aging of the population is a worldwide phenomenon. The expanding and aging global population is expected to result in increasing demand for healthcare products and services.

- The demand for self-monitoring one’s health is growing quickly. Medical devices bought by consumers to self-monitor their health will result in more medical equipment sales.

Bishop & Associates projects the worldwide market for medical cable assemblies to grow 4.1% in 2014 to $4.2 billion. At 7.6% year-over-year growth, Japan will be the fastest-growing region in 2014 for this market sector.

Dave Pheteplace, VP, Bishop & Associates, Inc.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019