Facts & Figures: Industrial Market Sector Sales Flat in 2014

With industrial market sector sales flat in 2014, it’s not surprising that sales across the sector tumbled in the first quarter of 2015.

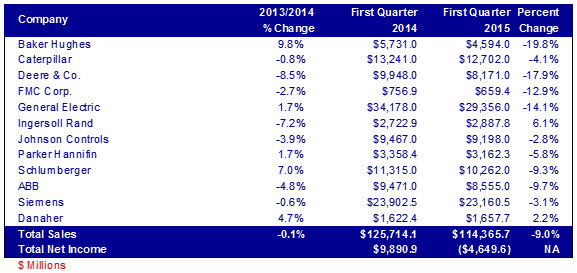

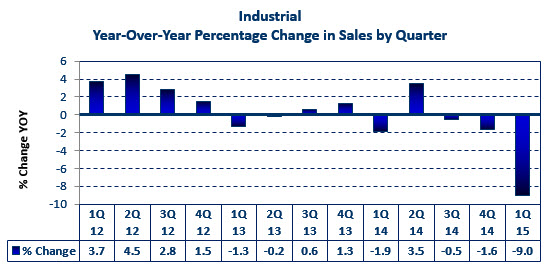

Bishop tracks 12 companies in the industrial market sector. These companies’ combined sales contracted year over year in the last three quarters ending with 1Q15. In 2013, these companies grew 0.1% year over year and they contracted 0.1% in 2014. In the first quarter of 2015, the companies contracted 9.0% over the prior year results. In comparison with these companies, the cable assembly market for the worldwide industrial market sector grew 3.6% in 2013 and 9.5% in 2014 due to increasing electronic content. The cable assembly market for industrial is projected to grow 4.0% in 2015.

Bishop follows electronic interconnect sales trends in 13 markets. The combined annual revenue of all the market sectors was $4.35 trillion in 2014 and grew 1.9% over 2013. Of the 13 market sectors, industrial was the third slowest-contracting market sector in 2014 at -0.1%, with combined revenues of $114.4 billion. Profitability was ($4.7) billion at -4.1% of sales due to a significant loss at GE as a result of discontinued operations.

Of the companies followed for industrial, only Ingersoll Rand and Danaher had sales growth in 1Q15 at 6.1% and 2.2% respectively. Six companies had double-digit declines in sales (or near double-digit declines).

Ingersoll Rand had an increase in 1Q15 of 6.1% year over year to $2,888 million. Revenues were down 10.9% from 4Q14. Net income was at 1.8% of sales, down 35% over the prior year. Sales in the US were up 11% and the EMEA was up 22% in local currencies.

Danaher grew its industrial sales 2.2% in 1Q15 to $1,658 million. Currency exchange cost the business approximately six percentage points in revenue growth.

Baker Hughes’ sales contracted 19.8% in 1Q15 to 4,594 million. According to Martin Craighead, Baker Hughes chairman and chief executive officer, “Our first quarter results are a reflection of the extreme market forces faced by our industry since late December. Consistent with past downturns, many of our customers have curtailed or canceled projects. The reduction in activity can clearly be seen in the North America rig count, which has been cut in half, dropping by more than 1,000 rigs so far this year. Similarly, international activity has begun falling, including significant rig count declines in Colombia, Mexico, Continental Europe, and Australia.”

Deere and Company year-over-year sales were down 17.9% in the calendar 1Q15. According to a company statement, “Net sales of the worldwide equipment operations declined 20% for the quarter and six months compared with the same periods a year ago. Sales included price realization of 2% for both periods and an unfavorable currency-translation effect of 5% for the quarter and 4% for six months. Equipment net sales in the United States and Canada decreased 14 percent for the quarter and year to date. Outside the US and Canada, net sales decreased 28% for the quarter and six months, with unfavorable currency-translation effects of 10% and 8% for the periods.”

GE’s total sales were down 14.1% year over year in 1Q15. Its industrial sales, however, were only down 1% at $23.8 billion with earnings of $2.8 billion. The cost of GE exiting its GE Capital business is $16.4 billion, resulting in a quarterly loss of $13.6 billion. It now will be primarily an industrial products company by its own definition.

The following table shows the results for the 12 companies Bishop tracks in the industrial market sector.

Industrial Market Sector – Sales and Net Income

As shown in the following chart, year-over-year sales results have been contracting since 2Q14. Sequentially, first quarter 2015 sales were down 14% from the fourth quarter of 2014.

Trends in the Industrial Market

- The uncertain economic recovery in the mature economies and the slowdown of China’s economy will negatively impact growth in the industrial market in 2015.

- The low cost of crude oil will negatively impact the industrial market. Lower prices mean less exploration, due to abundant supplies, and less installation of new rigs. For energy exploration, cable assemblies are used extensively in seismic exploration equipment, pipe production equipment, and drilling equipment. On the production side, cable assemblies are found in the pumping and monitoring equipment.

- The industrial market sector tends to do well when medium to heavy industry is doing well, which will drive demand for cable assemblies.

- In a strong automotive market, updates to and expansion of the production lines means more cable assemblies required to operate robotic systems and welding equipment. Additional mold and stamping presses, which use cable assemblies, also are required to produce parts.

- The strong commercial aircraft market has increased requirements for equipment used in the production of parts and assemblies.

- In electrical generation and distribution equipment, smart grid technology allows the service providers to do more with existing infrastructure, thus saving them money and improving service. The smart grid is controlled by SCADA (supervisory control and data acquisition) equipment which is forecast to grow at a 7% CAGR during the next five years. This equipment includes bay controllers, substation servers, sectionalizer controllers, and other equipment, which use cable assemblies extensively.

Bishop & Associates estimates the worldwide market for industrial cable assemblies will grow 4.0% in 2015. At 31% year-over-year growth, China will be the fastest-growing region in 2015 for this market sector. The cable assembly market is projected to grow 5.2% in 2015.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019