Facts & Figures: Medical Market Sector Sales

Medical market sector sales are up 15.3% in 1Q15, driven by the Medtronic/Covidien merger.

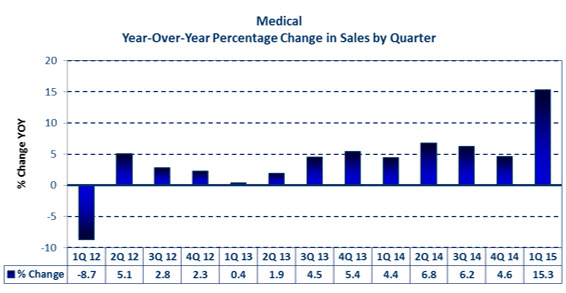

Bishop tracks eight companies in the medical market sector. These companies’ combined sales have grown year over year for the past 12 consecutive quarters, ending with 1Q15. These companies grew 3.0% year over year in 2013 and 5.5% in 2014. In the first quarter of 2015, the companies expanded 15.3% over the prior year results. In comparison with these companies, the cable assembly market for the worldwide medical market sector grew 0.3% in 2013 and 5.8% in 2014. The cable assembly market for the medical sector is projected to grow 3.3% in 2015.

Bishop tracks eight companies in the medical market sector. These companies’ combined sales have grown year over year for the past 12 consecutive quarters, ending with 1Q15. These companies grew 3.0% year over year in 2013 and 5.5% in 2014. In the first quarter of 2015, the companies expanded 15.3% over the prior year results. In comparison with these companies, the cable assembly market for the worldwide medical market sector grew 0.3% in 2013 and 5.8% in 2014. The cable assembly market for the medical sector is projected to grow 3.3% in 2015.

Bishop follows electronic interconnect sales trends in 13 markets. The combined annual revenue of all the market sectors was $4.35 trillion in 2014 and grew 1.9% over 2013. Of the 13 market sectors, medical was the fifth fastest-growing market sector in 2014 at 5.5%, with combined revenues of $79.9 billion. Profitability was $8.9 billion at 11.2% of sales.

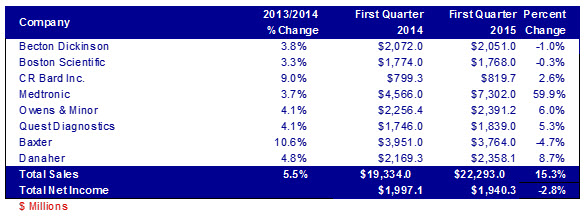

Of the companies followed for medical, Medtronic had the largest quarterly growth at 59.9%. Four companies had low to upper single-digit increases in sales, and three had small single-digit declines.

Medtronic grew calendar 1Q15 sales to $7,302 million. The large increase in sales was due to the acquisition of Covidien. On a pro forma basis, the combined companies’ sales were up 7%. “I am very encouraged by our strong preliminary fourth quarter revenue performance especially as it is the first quarter that reflects the combined results of Medtronic and Covidien,” said Omar Ishrak, Medtronic chairman and chief executive officer. “In addition to making solid progress on our integration of Covidien, these preliminary revenue results reflect disciplined execution across our three core strategies of therapy innovation, globalization, and economic value.”

Danaher grew its medical sales 8.7% in 1Q15 to $2,358 million. The company acquired three businesses in the first quarter, with combined annual sales of $245 million, which complement its medical and industrial businesses.

Owen & Minor’s sales grew 6.0% in 1Q15 to $2,391 million. In a statement the company announced: “Domestic segment revenues for the first quarter of 2015 were $2.29 billion, increased $137 million, when compared to the prior year’s first quarter revenue. Excluding the impact of the domestic acquisition completed in the fourth quarter of 2014, domestic revenues grew 4.7% in the first quarter. Domestic segment revenue growth resulted primarily from larger healthcare provider customer accounts and new business; these positive trends offset declines from smaller customer accounts.”

Quest Diagnostics grew 5.3% in 1Q15 year over year to $1,839 million including acquisitions. On an organic basis, growth was 0.7% year over year.

The following table shows the results for the eight companies Bishop tracks in the medical market sector.

Medical Market Sector – Sales and Net Income

As shown in the following chart, year-over-year sales results have been growing since 2Q12. Sequentially, first quarter 2015 sales were up 8.3% from the fourth quarter of 2014.

Trends in the Medical Market

- The healthcare reform act of 2010 is having a negative impact on the medical equipment market in North America in multiple ways.

- Medical equipment manufacturers are bearing the cost of a 2.3% excise tax on their equipment, which is driving up their costs.

- The uncertainties of how the act will continue to run is causing healthcare providers to be very cautious about spending money for equipment.

- The healthcare reforms are driving many private practitioners out of business because they cannot compete with the larger providers, thus, there are fewer offices buying equipment.

- The recessions and economic difficulties in several of the European countries have curtailed spending on medical equipment. With socialized medicine in most European countries, the governments under austerity budgets cannot afford to spend money on new equipment.

- Aging of the population is a worldwide phenomenon. The expanding and aging global population is expected to result in an increasing demand for healthcare products and services.

- China and India have the largest populations in the world. Will they spend the most on healthcare? China has a population of 1.36 billion and a per capita healthcare spend of $322 per year. India has a population of 1.27 billion and a per capita healthcare spend of $62. In comparison, Germany spends $4,683 and the US spends $8,895.

- The demand for self-monitoring one’s health is growing quickly. Medical devices bought by consumers to self-monitor their health will result in more medical equipment sales.

Bishop & Associates estimates the worldwide market for medical cable assemblies will grow 3.3% in 2015. At 9% year-over-year growth, China will be the fastest-growing region in 2015 for this market sector. The cable assembly market is projected to grow 5.2% in 2015.

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019