The Transportation Market is Flying High

The transportation market is flying high, after steady growth over the last five quarters.

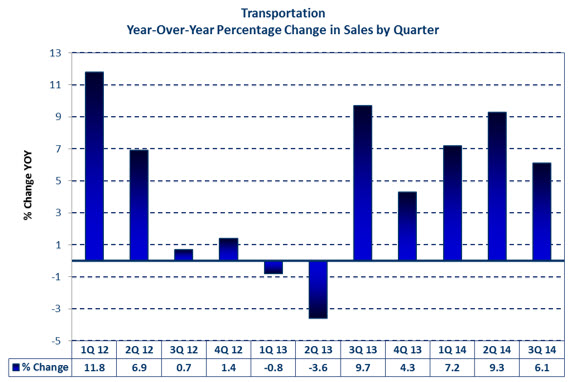

Bishop tracks 13 companies in the transportation market sector. This market has shown steady growth over the last five quarters, as measured by these 13 companies’ revenues. In 2013, these companies grew 2.6% year over year. In 1Q14, the combined revenues of these companies grew 7.2% year over year; in 2Q14 they grew 9.3% over the prior year; and 6.1% in 3Q14. In comparison to these companies, the cable assembly market for the worldwide transportation market sector grew 2.8% in 2013 and is forecasted to grow 8.8% in 2014.

Bishop tracks 13 companies in the transportation market sector. This market has shown steady growth over the last five quarters, as measured by these 13 companies’ revenues. In 2013, these companies grew 2.6% year over year. In 1Q14, the combined revenues of these companies grew 7.2% year over year; in 2Q14 they grew 9.3% over the prior year; and 6.1% in 3Q14. In comparison to these companies, the cable assembly market for the worldwide transportation market sector grew 2.8% in 2013 and is forecasted to grow 8.8% in 2014.

Bishop follows electronic interconnects sales trends in 13 markets. The combined annual revenue of all the market sectors was $4.24 trillion in 2013 and grew 0.8% over 2012. Of the 13 market sectors, transportation was the fifth fastest growing market sector in 2013 at 2.6%, with combined revenues of $341.3 billion. Profitability was $18.3 billion at 5.4% of sales.

This market sector, in particular, has done well as the economies of the world have picked up. Commercial airplanes (Boeing, EADS, and Bombardier), the rail industry, and trucks are all growing segments.

Trinity Industries has had the most growth for the first three quarters of 2014 at 45.0%. Third quarter sales were up 40.8% over 2013 at $1,110.3 million. The company’s products include railcars, inland barges, and pressurized/non-pressurized containers and tanks.

“During the third quarter, Trinity generated record revenues and its 17th consecutive quarter of year-over-year growth in net earnings,” said Timothy R. Wallace, Trinity’s chairman, CEO, and president. “Our major businesses reported a record combined backlog valued at more than $7.1 billion at the end of the third quarter, representing 15% growth year over year.”

Westinghouse Air Brake had the second largest increase in sales in the first three quarters of 2014 at 18.0% year over year to $2,456 million. 3Q14 revenues were up 26.3% year over year. The company reports that about half of the sales growth was attributed to acquisitions.

Daimler truck and bus sales are up 13.7% for the first three quarters of 2014 to $45,651 million. Unit sales were up 1% for trucks, up 11% for vans, and down 11% for buses.

Boeing had the most growth of the commercial aviation companies on our list. Boeing sales are up 12.7% year to date over prior year to $43,151 million. At the end of the third quarter, Boeing had a record backlog of $490 billion with orders for more than 5,500 commercial planes. For the first nine months of 2014, Boeing delivered 528 planes (up 11% from 2013) for an average of more than 58 planes per month.

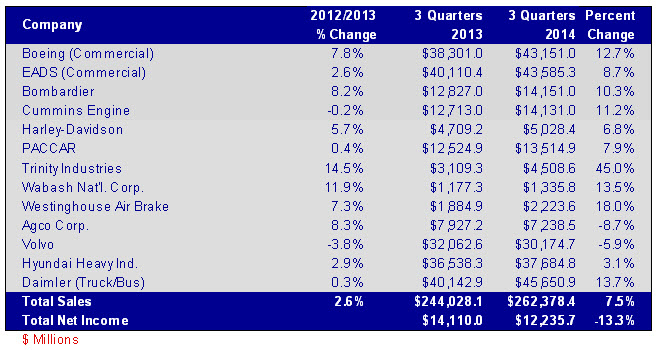

The following table shows the results for the 13 companies we track in the transportation market sector.

Transportation Market Sector – Sales and Net Income

As shown in the following chart, year-over-year sales growth has been relatively steady since 3Q13. Sequentially, third quarter 2014 sales were down 2.1% from the second quarter of 2014.

Trends in the Transportation Market

- The production of narrow-body aircraft has been picking up worldwide to accommodate an increase in regional air travel.

- Boeing and Airbus have been the major beneficiaries from this increase in business for Boeing’s 737 series and Airbus’s 320 series.

- COMAC, Commercial Aircraft Corporation of China, plans to compete with Boeing and Airbus with the C919. The first flight of the C919, however, has been delayed until late 2015 with no deliveries until at least 2018. Its ARJ21, a regional jet, received certification from the Civil Aviation Administration of China in December 2014 and the first plane will go into service by May 2015.

- In addition to the narrow-body aircraft, regional jet manufacturers Embraer and Bombardier see a market for 7,000 of the 70-to-100 seat aircraft over the next 20 years.

- The narrow-body and wide-body aircraft now use more fiber optic assemblies. To reduce weight and improve fuel economy, fiber optic assemblies and bus systems are being used extensively in the newer models of aircraft from Boeing and Airbus.

- The new emission standards for Class 8 trucks will result in more cable assembly opportunities in new vehicle and possibly retrofits of existing truck assemblies. In addition, the trucks will now have diagnostic ports that will require cable assemblies to download information to the diagnostic equipment.

- The falling price of oil (and fuels) should lead to higher profits for service providers using transportation equipment (trains, planes, and trucks). The increasing profitability of the service providers may lead to additional equipment purchases.

- Ship building should see more activity. With the economies in the US and Europe picking up, exports and imports are increasing. Although there was a glut of all types of ships, the inventory of under-utilized ships is decreasing, so we should see more business in that segment, particularly for ship builders in China and South Korea.

Bishop & Associates projects the worldwide market for transportation cable assemblies to grow 8.8% in 2014 to $8.6 billion. At 13.1% year-over-year growth, China will be the fastest growing region in 2014 for this market sector.

[hr]

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019