Computer Market Contracts, Tablets and Smartphones Grow

PC unit sales declined 10% in 2013 for the second straight year of contraction, as the computer market contracts and swaps PCs for tablets and smartphones.

Bishop tracks 11 companies in the computer market sector and 10 companies in the peripheral market sector. This market has been in contraction, as measured by these 21 companies, for the last two years (except peripherals in 2012), with a year-over-year contraction of 2.9% and 5.0%, respectively, in 2013. In comparison to these companies, the cable assembly market for the worldwide computer and peripheral market sector contracted 2.7% year over year in 2012 and was flat in 2013 at 0.1%. Global PC shipments declined 3% in 2012 and 10% in 2013, so the results in the cable assembly market are not surprising. Cable assembly sales declines in 2012 and 2013 were somewhat offset by tablet sales.

Bishop tracks 11 companies in the computer market sector and 10 companies in the peripheral market sector. This market has been in contraction, as measured by these 21 companies, for the last two years (except peripherals in 2012), with a year-over-year contraction of 2.9% and 5.0%, respectively, in 2013. In comparison to these companies, the cable assembly market for the worldwide computer and peripheral market sector contracted 2.7% year over year in 2012 and was flat in 2013 at 0.1%. Global PC shipments declined 3% in 2012 and 10% in 2013, so the results in the cable assembly market are not surprising. Cable assembly sales declines in 2012 and 2013 were somewhat offset by tablet sales.

Bishop follows electronic interconnect sales trends in 13 markets. The combined annual revenue of all the market sectors was $4.24 trillion in 2013 and grew 0.8% over 2012. Of the 13 market sectors, computer and peripheral were the two slowest-growing market sectors in 2013, with combined revenues of $515.6 billion. Profitability was $45.3 billion at 8.8% of sales.

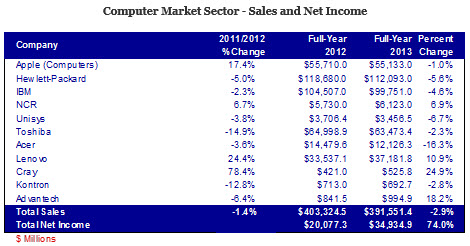

Cray had the most growth of the computer companies at 24.9% year over year and finished the year with total sales of $526 million. It attributed the growth to record supercomputer shipments and to growth in big data and analytics.

Advantech manufactures and sells embedded computing boards, industrial automation products, applied computers, and industrial computers. Its 2013 estimated sales (for 4Q13) were $995 million, up 18.2% over 2012 full-year sales.

Lenovo grew 10% in calendar 2013 to $37,182 million, making it the largest PC manufacturer. It attributes its success to aggressively protecting its PC business while simultaneously expanding its smartphone and tablet businesses.

NCR, which is a leading manufacturer of point-of-sale devices, saw revenues grow 6.9% in 2013 to $6,123 million. 48% of NCR’s sales are in products. NCR reported growth in its retail solutions, hospitality, and emerging industries business segments.

For the remaining computer companies, sales declines ranged from -16% to -1%. Several of these companies suffered from declining PC sales.

The following table shows the results for the 11 companies we track in the computer market sector.

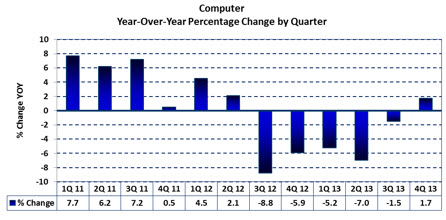

As shown in the following chart, year-over-year sales have been in the low single-digit range or negative over the last six quarters. Sequentially, fourth quarter 2013 sales increased 9.6% from the third quarter of 2013.

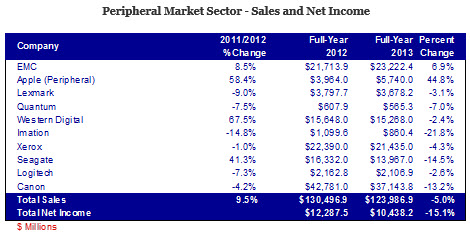

With the exceptions of Apple and EMC, all of the peripheral companies experienced sales declines in 2013. Much of these sales are directly tied to the sale of PCs, so the results are not surprising.

Apple’s peripheral sales increase may have been helped by the sale of Apple-branded and third-party accessories for the iPhone, iPad, Mac, and iPod, but the company does not break these sales out separately. EMC is number one in storage and is benefiting from the growth in mobile computing.

The following table shows the results for the 10 companies we track in the peripheral market sector.

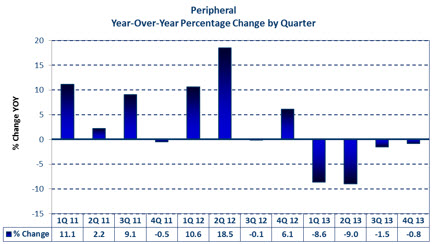

As shown in the following chart, year-over-year sales have declined over the last four quarters. Sequentially, fourth quarter 2013 sales increased 11.4% from the third quarter of 2013.

Trends in the Computer and Peripheral Markets

- Smartphones and tablets will continue to displace PC sales as people become aware that the mobile devices provide the features they need without the expense of more traditional PCs.

- Smartphones and tablets use less external cable assemblies in favor of wireless technology.

- Data centers and Big Data will continue to be driven by mobile devices.

Bishop & Associates projects the worldwide market for computer and peripheral cable assemblies to grow 5.7% in 2014 to $20.3 billion. At 6.0% year-over-year growth, Japan will be the fastest-growing region in 2014 for this market sector.

Dave Pheteplace, VP, Bishop & Associates, Inc.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019