Put It in Your Pocket: The Computer & Peripheral Market Goes Mobile

The computer sector was the third-slowest growing market sector in 2012 at -0.8% year-over-year and combined revenues of $467 billion.

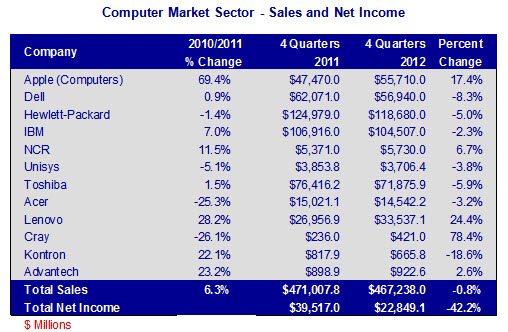

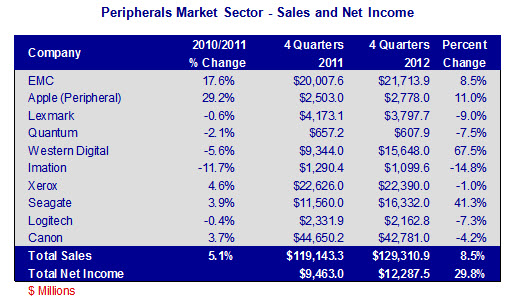

Bishop tracks 13 market sectors for electronic interconnects. The combined annual revenue of all the market sectors was $4.3 trillion in 2012 and grew 4.9% over 2011. Of the 13 market sectors, the computer sector was the third-slowest growing market sector in 2012 at -0.8% year-over-year and combined revenues of $467 billion. Profitability was $22.9 billion at 4.9% of sales. Peripherals were the second-fastest growing sector at 8.5% year-over-year, with combined revenues of $129 billion. Profitability was $12.3 billion at 9.5% of sales.

Computers

Cray Computer had the largest year-over-year increase in sales at 78.4% to $421 million in 2012. Cray attributes its growth to the introduction of its new cluster solutions and XC30 supercomputer.

Lenovo grew 24.4% in 2012 to $33.5 billion. Lenovo attributes its growth to taking market share from competitors in the PC market and strong smartphone sales in China.

Apple Computer had sales growth of 17.4% to $55.7 billion in 2012. Apple’s iPad sales are included in this number, which is a good portion of its growth. In addition, Apple’s computer sales reportedly haven’t been as severely impacted by the industry PC downturn as standard PCs.

Dell, Hewlett-Packard, Toshiba, and Acer were all primarily impacted by the downturn in the PC market.

Kontron’s sales contracted 18.6% in 2012. Kontron, a leader in embedded computer technology, said that the decline was due to “challenging market conditions and far-reaching restructuring measures.”

The following table shows the results for the 12 companies we track in this market sector.

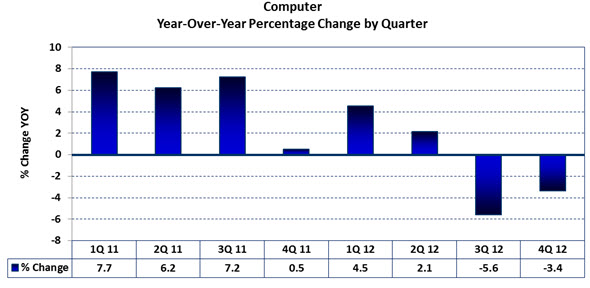

In the following chart, year-over-year sales growth has declined for the past two quarters. Sequentially, fourth quarter 2012 sales increased 5% from the third quarter of 2012.

Peripherals

Western Digital had the largest year-over-year growth in the peripheral sector at 67.5% and $15.6 billion in sales. Despite weak PC sales, the demand for storage, due to high-definition media consumption, is driving the strong sales performance at Western Digital.

Seagate is riding the same wave as Western Digital: Sales growth in 2012 was 41.3% to $16.3 billion.

EMC, one of the larger companies in our analysis of peripherals, had growth of 8.5% in 2012 to $21.7 billion. Part of EMC’s success is tied to its storage equipment’s use in cloud computing.

Lexmark, Xerox, and Canon all seem to be facing the same conundrum — they need to make the change from what their businesses were to what they need to be to ensure future success.

The following table shows the results for the 10 companies we track in this market sector.

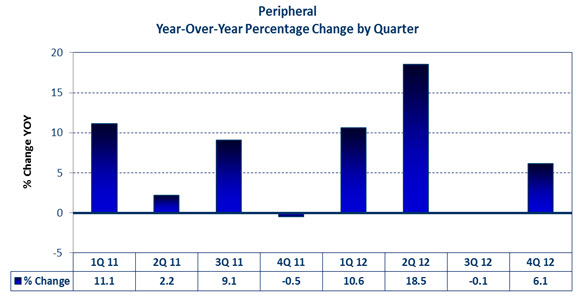

In the following chart, year-over-year sales growth has been relatively good in 2012, with the exception of 3Q12. Sequentially, fourth quarter 2012 sales increased 10.6% from third quarter 2012.

Trends in the Computer/Peripheral Industry

As mentioned up front, the computer industry is going through significant upheaval. Gone are the days of the smaller, ever-faster PCs: These are giving way to smaller, more powerful mobile devices.

What can we expect?

- Laptop and desktop computer functionality will be replaced by tablet/smartphone architectures, which satisfy the needs of most computer users.

- The increasing use of cloud computing by mobile devices will increase their functionality and further reduce the need for traditional PCs.

- Increased server resources will be needed to facilitate cloud computing.

- The virtualization of server resources will continue, resulting in 10:1 streamlining of hardware resources.

- Micro-server technology, such as HP’s Moonshot program, will expand, and provide up to a 90% reduction in power consumption.

Impact on the Cable Assembly Industry

- Mobile devices tend to use less external cabling than PCs; the charging cable is the main or only external cable.

- Internal cabling for mobile devices tends to be on flex circuits, eliminating traditional wire harness and FRC assemblies.

- Servers and server farms use significant amounts of internal and external cabling. Micro-servers, however, will require less cabling.

- The final trade-off in cabling requirements for the switch to mobility is yet to be fully understood, as the technology is evolving. However, the change in the types of cabling is trending toward miniaturization and flex circuitry.

Bishop & Associates projects the worldwide market for computer/peripheral cable assemblies to be up 4% in 2013 to $9.8 billion. China will be the fastest-growing region in 2013 for this market sector.

No part of this article may be used without the permission of Bishop & Associates Inc.

If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019