The Facts and Figures of Military Strategy

Competition in the defense industry will continue to become more global and intense. Facts and figures of military strategy show the defense sector has more players than future demand can profitably support.

Governments and defense agencies in 2013 — from the US to China to the eurozone — had to justify defense spending against a broad range of domestic priorities. In the US and Western and Central Europe, austerity measures continue to reduce military spending. In contrast, nations with emerging economies have experienced economic growth with lower levels of debt and are tackling regional security challenges with higher levels of defense spending.

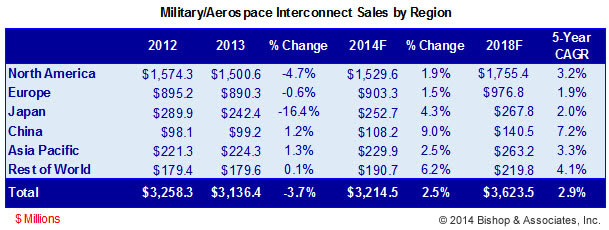

In 2013, North America accounted for 48% of global interconnect sales. Europe is second with 28%, followed by Japan at 8%. Over the forecast period, there will be a trend of marginally reduced market share by these regions, with growth in the China, Asia Pacific, and ROW regions. Bishop projects that connector sales in the military/aerospace connector market will grow by 2.5% from the $3,136 million sales recorded in 2013 to a value of $3,214 million in 2014.

Competition in the defense industry will continue to become more global and intense. The defense sector currently contains more players than future levels of demand can profitably support. The last time there was a big downturn in military demand in the ’90s, two-thirds of the top military contractors disappeared through mergers, spinoffs, and other exit strategies. Expect to see an increase in the number of partnerships and joint ventures, with new collaborations forming with non-aligned industries.

The US Pentagon FY2015 budget request will be presented to Congress on March 4. Its proposed cuts are in line with the Bipartisan Budget Act, which imposes a military spending cap of about $496 billion for FY2015. The proposal puts money toward new projects, including cyber warfare capabilities, a new combat vehicle, next-generation aircraft, and new high-performance jet engine technology. The proposal also recommends termination of the Army Ground Combat Vehicle (GCV) program and retirement of the U-2 spy plane in favor of the remotely piloted Global Hawk.

The US Pentagon FY2015 budget request will be presented to Congress on March 4. Its proposed cuts are in line with the Bipartisan Budget Act, which imposes a military spending cap of about $496 billion for FY2015. The proposal puts money toward new projects, including cyber warfare capabilities, a new combat vehicle, next-generation aircraft, and new high-performance jet engine technology. The proposal also recommends termination of the Army Ground Combat Vehicle (GCV) program and retirement of the U-2 spy plane in favor of the remotely piloted Global Hawk.

The entire fleet of Air Force A-10 attack aircraft would be eliminated. There are already plans in effect to reduce the US Army to its smallest force since before the World War II buildup.

European defense contractors have found it difficult to forecast the impact of reduced defense spending by US and European governments due to slow decision-making among lawmakers and the long-dated nature of some defense equipment contracts. Britain, France, and Germany represent 60% of the EU’s military expenditures. While Britain has the largest military in Europe, it is undergoing massive budget cuts. Germany is the only country of the big three not facing serious defense cuts and it has the potential to emerge as the biggest military in Europe.

Japan continues to improve its defense posture with the addition of new helicopter carriers, Aegis destroyers, and increased ISR capabilities. Faced with an increasingly demanding security environment, Japan is looking to make significant changes to its security policy, by eliminating their expansive ban on arms exports, allowing shipments to countries involved in international conflicts. The draft proposal means that Japan would lift the ban on many destinations as long as they are not sponsoring terrorism or violating international treaties on ammunition.

China has become increasingly assertive in the region, rapidly developing air and naval capabilities, missile systems, and cyber warfare. Chinese companies are now aggressively pushing foreign sales of high-tech hardware to developing economies. Industry analysts believe China is still a decade away from competing head-to-head with Western nations on defense-related technology, but Chinese equipment is priced lower, and very attractive to emerging markets.

China has become increasingly assertive in the region, rapidly developing air and naval capabilities, missile systems, and cyber warfare. Chinese companies are now aggressively pushing foreign sales of high-tech hardware to developing economies. Industry analysts believe China is still a decade away from competing head-to-head with Western nations on defense-related technology, but Chinese equipment is priced lower, and very attractive to emerging markets.

Indian defense spending took a hit in 2013, as the rupee has fallen in value since February, when the defense budget was announced. $1.3 billion intended for new weapons and equipment was diverted to pay salaries, pensions, and other day-to-day equipment for the troops. The fate of defense projects in the pipeline will be decided by the next government, scheduled to take over in June 2014.

Russia remains one of the world’s most successful arms exporters, with Russian-made tanks and helicopters among the best-sold products (mostly outside of NATO). While a wide range of regions have been hit by the defense recession, Russia continues to show significant increases. That increase coincides with a greater push by the Russian government to sell arms overseas. Two of Russia’s largest defense customers, China and India, have helped to rapidly boost their military spending. A key aspect of the future of the military/aerospace sector for the ROW region is going to be the spending habits of developing regions. While impacted by troubled economies in 2013, this region has potential for significant growth.

Russia remains one of the world’s most successful arms exporters, with Russian-made tanks and helicopters among the best-sold products (mostly outside of NATO). While a wide range of regions have been hit by the defense recession, Russia continues to show significant increases. That increase coincides with a greater push by the Russian government to sell arms overseas. Two of Russia’s largest defense customers, China and India, have helped to rapidly boost their military spending. A key aspect of the future of the military/aerospace sector for the ROW region is going to be the spending habits of developing regions. While impacted by troubled economies in 2013, this region has potential for significant growth.

- State of the Industry: 2022-2023 Connector Sales - April 16, 2024

- Amphenol is On a Roll - April 2, 2024

- Nicomatic Proves That Two Heads are Better Than One - March 26, 2024