Distribution Posts First Negative Quarter Since 2009

Sales have slowed down, but there’s no reason to panic: These numbers are acceptable and distributors maintain a positive business outlook. History says it’s all part of the normal business cycle, but Bishop & Associates is keeping a close eye on it.

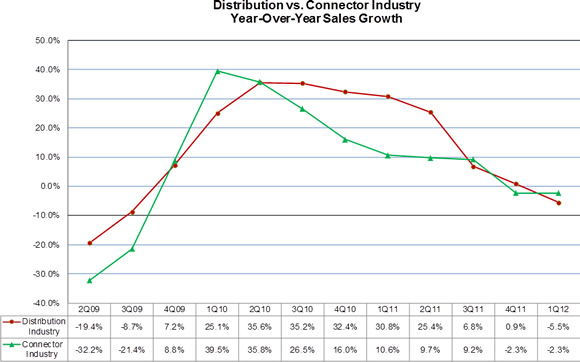

The electronic component distribution industry posted sales down -5.5% from the prior year in the first quarter of 2012. This marks the first time since the third quarter of 2009 that distribution sales failed to post a year-over-year increase. Distribution sales increased sharply following the 2009 recession with a peak year-over-year growth of +35.6% in the second quarter of 2010. Since then, the percentages of growth have decreased in each quarter, and finally slipped into negative territory at the beginning of this year.

The connector industry as a whole broke its streak of quarters with consecutive growth, also dating back to 3Q09, in the fourth quarter of last year. Year-over-year sales were down -2.3% that quarter and were down by the same amount (-2.3%) in the first quarter of 2012. Distribution was able to post a small increase of +0.9% in 4Q11, but its decrease in 1Q12 puts it back in line with the overall connector industry. Commenting on his company’s results, Michael J. Long, chairman, president, and chief executive officer of Arrow Electronics, said, “The Americas region performed well, while weaker macroeconomic conditions in Asia and Europe have had a negative impact on our results.”

Since semiconductor and passive components generate the largest portion of distribution’s sales, their overall performance is often considered an indicator of future trends in the connector industry. As demonstrated in the following chart, however, connector sales growth began to decline three quarters before the overall distribution number, with the two tracking each other closely over the past nine months.

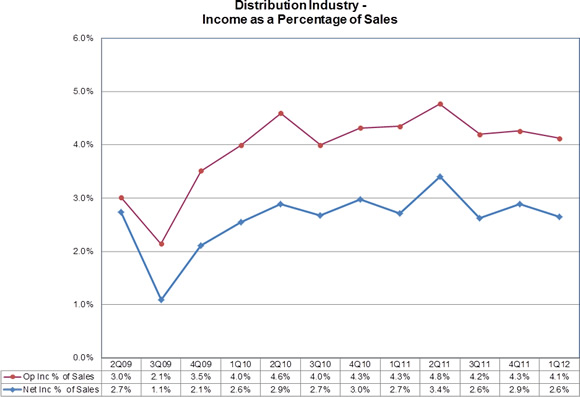

Income Levels Remain Stable

As a whole, the publicly held distributors posted year-over-year decreases in both operating and net incomes in the first quarter. As the following chart shows, however, they did maintain income levels within historically acceptable ranges.

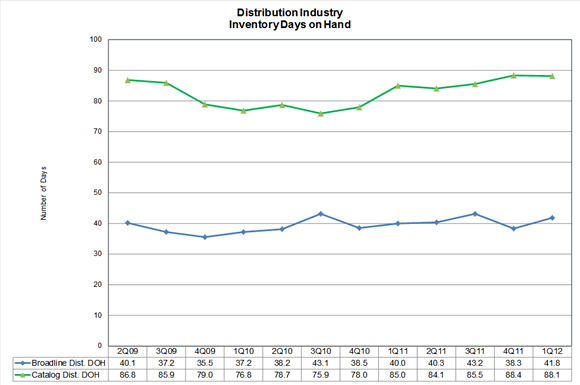

Inventories Under Control

Inventory levels are some of the most critical metrics for both distributors and suppliers. When they get too high, they negatively impact a distributor’s cash flow. When the distributor tries to bring them back in line (i.e., decrease levels until they are back in a range supported by current and projected sales), they stop ordering. The impact on suppliers can be severe, as it almost always comes at a time when their business is already slow. Distributors measure inventory levels by how many times they turn their stock each year. Typically, the higher the turns, the better the numbers. They can also measure levels by calculating the number of days it would take to deplete their inventory at current sales levels. The resulting number is referred to as inventory days-on-hand, or DOH. From a financial perspective, the lower this number is, the better.

Depending on their business model, distributors set inventory targets that they feel will maximize both their sales and return on investment. As demonstrated in the following chart, these target numbers vary greatly between broadline distributors and catalog distributors. The good news is that in both cases, DOH has remained relatively stable and well within historic parameters.

Q2 Outlook is Mixed

Bishop & Associates is projecting weak sales performance for the connector industry in the second quarter, followed by modest growth in the second half of the year. Based on overall positive book-to-bill ratios, we project that the distribution industry will recover more quickly, with growth of +2.3% in the second quarter. Third- and fourth-quarter growth projections are for +5.5% and 9%, respectively.

The individual distributors are in general agreement, but emphasize the uncertainties of the global economic picture and particularly the sovereign debt issues in many European countries. Harriett Green, CEO of Premier Farnell, expressed her company’s outlook this way: “We remain cautious on the economic outlook as the market continues to be uncertain and the nature of our business gives us limited forward visibility.”

Arrow Electronics has provided guidance for the second quarter of sales in the $5 to $5.4 billion range. If accurate, these number would represent an increase in the +2% to +10% range over Q1, but would still represent a slight decrease from 2Q11 levels. “Our global book-to-bill of 1.04 to 1 is at its highest level in six quarters, with sequential increases seen in all regions,” Long said. Avnet’s guidance is in the $6.3 to $6.9 billion range. At the high end, this would result in an increase of 9.5% over Q1 and put them flat with the same time period last year.

[hr]

No part of this article may be used without the permission of Bishop & Associates Inc.

If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.