The Two Faces of the Russian Connector Market

The Two Faces of the Russian Connector Market

At this year’s HANNOVER MESSE, held in April, the Russian Federation made a splash as the Partner Country. The Russian Federation’s exhibitors’ focused on energy, industrial automation, and new materials. The world’s most important technology event was a great opportunity to showcase the strengths of the Russian Federation as the world’s sixth biggest economy and as a business location. The list of Russian exhibitors included Gazprom, Rosnano, Russian Railway, Rosneft, Transnest, UralVagonZavod, RAO UES of Russia, Vnesheconombank, TMKGroup, Metalloinvest, and other major companies. Never before have so many Russian companies taken part in an industrial show outside of Russia.

At this year’s HANNOVER MESSE, held in April, the Russian Federation made a splash as the Partner Country. The Russian Federation’s exhibitors’ focused on energy, industrial automation, and new materials. The world’s most important technology event was a great opportunity to showcase the strengths of the Russian Federation as the world’s sixth biggest economy and as a business location. The list of Russian exhibitors included Gazprom, Rosnano, Russian Railway, Rosneft, Transnest, UralVagonZavod, RAO UES of Russia, Vnesheconombank, TMKGroup, Metalloinvest, and other major companies. Never before have so many Russian companies taken part in an industrial show outside of Russia.

The success of HANNOVER MESSE will play a significant role in further intensifying economic relations between Germany and Russia. Bilateral trade between Germany and Russia reached a new high of over 80 billion euros in 2012. The admission of the Russian Federation to the WTO in 2012 will boost trade and open up new business opportunities for foreign companies. To illustrate the significance of the exhibition, Vladimir Putin, president of the Russian Federation, attended HANNOVER MESSE 2013 and also took part in the traditional opening tour of HANNOVER MESSE, along with German Chancellor Angela Merkel.

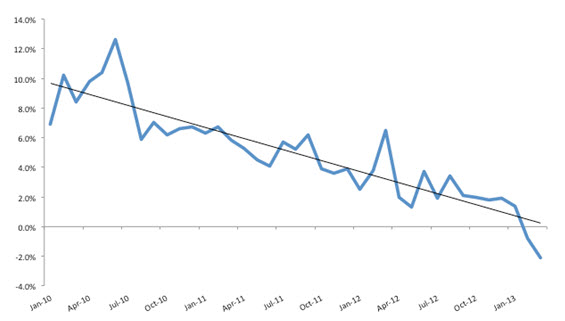

Russian Industrial Output Trend

The Russian Federation should benefit from more international trade once the country fully complies with WTO rules in 2018, as its industrial production growth has been in decline over the past three years and has even moved into negative territory in 2013.

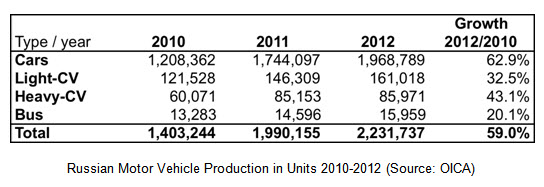

Amid this decline, one of the sectors that continued to grow was the automotive market (see table below). Between 2010-2012 the production of passenger cars and light commercial vehicles in Russia increased by 63% and 33% respectively. During the same period, the production of heavy vehicles (trucks) and buses also increased by 43% and 20% respectively. These increases may be the result of the decision by the Russian government to give foreign investors in the automotive sector more freedom.

Russian Industrial Production Year-Over-Year (%)

One of the weak points of the Russian economy is its dependency on income from oil and gas exports, as well as exports of other minerals and natural resources. Fluctuations in the world market prices for these resources immediately affect the country’s income and may instantly either create a surplus or a deficit, depending on the way the prices develop. With the world in a fragile recovery mode from the 2008/2009 crisis, and with economic weakness likely to continue in regions like Europe for years to come, the demand for oil and gas may actually only increase slowly and prices may effectively decrease.

Russian Electronics Industry

The Russian electronics industry has also gone through some ups and downs over the past two decades. Earlier this millennium, the industry initially received a boost from the new Russia that emerged from the rubble of the old Soviet empire, but it has since deteriorated, as the government decided the country would do well to live off oil, gas, and mineral exports instead of developing a diverse and sustainable portfolio of industries. When oil and gas prices fell as a result of the financial crisis and dragged Russia into a deep recession, the government realized it had to revive its manufacturing base, and today a new industrial policy is being developed. To illustrate the effort, since 2009, around 600 state industrial firms with a total of 900,000 employees were transferred to Russian Technologies (RT), a restructuring agency.

A lot of companies in the RT portfolio are in financial trouble and/or their assets appear to have little value, but it also includes some very promising companies in areas such as electronics, optical instruments, and metallurgy. Most of these are active in both military and civilian projects. The MC-21 airliner, built by the newly created United Aircraft Corporation (UAC), with its maiden commercial flight planned for 2015, is a symbol of the industrial revival. While Russia has been an exporter of military aircraft, its commercial aircraft are hardly ever sold outside the former Soviet Union. With the MC-21, UAC will try to gain a place in the world market now dominated by Airbus and Boeing. Russia’s entry into the WTO may eventually lead to an (industrial) investment boom and revival of the manufacturing industry, if, at the same time, the country succeeds in improving its business climate. Reviving Russian industry will most likely be a long process, not without difficulty and hurdles, as illustrated by a survey done by The Economist.

Biggest Obstacles to Doing Business in Russia (2010-2011)

(Source: The Economist)

- Corruption

- Access to financing

- Tax regulations

- Crime and theft

- Inflation

- Government bureaucracy

The Two Faces of the Russian Connector Market

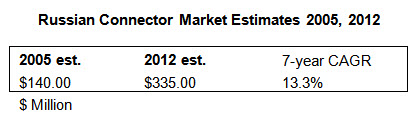

When Bishop & Associates tried to profile the Russian connector market for the first time in 2006, we valued the Russian connector market at just under $140 million. There was little transparency in the connector market in those years, partly because the market was still dominated by (formerly) state-owned companies from the Soviet era that were still working largely for military applications and manufacturing products that were based on sometimes old-fashioned, Soviet military specifications. At the time the best, most accessible opportunities for international connector manufacturers were found in the automotive and industrial markets, while the military connector market was still heavily state-controlled.

Today we see a similar picture and the best sales opportunities are found in the automotive industry, followed by the industrial market (machinery). Entry to the military market is still difficult for foreign connector manufacturers, and other market sectors have not developed yet, as setting up manufacturing plants in other BRICS countries is more appealing to many companies. Nevertheless, through an increase in domestic demand over the past decade and growth in selected industries, Bishop & Associates estimates the Russian connector industry has been growing by double-digit numbers, in the range of 12-14% per year over the past seven years through 2012. This means the Russian connector market reached a volume between $310-$360 million in 2012.

To understand today’s Russian connector market better, we need to understand how it was built.

History of the Russian Connector Market

The roots of the present-day Russian connector market lie in the Soviet past, when there was no freely accessible connector market at all. All 20+ manufacturing plants that were engaged in connector manufacturing were state-owned and supplied connectors to other state-owned enterprises via centralized procurement procedures, or so called “goszakaz” (state order). These 20+ plants were concentrated in five of 16 Soviet republics. The plants were distributed among these five republics as follows: 11 in the current Russian Federation, six in the Ukraine, four in Kirgizia, three in Armenia, and one in Georgia. At the end of Soviet era (1990) these 20+ plants manufactured a wide range of electrical/electronic connectors according to military and civil (but state-owned) demand and specifications.

After the breakdown of the USSR in 1991, the situation changed dramatically. Borders were established between ex-Soviet republics and centralized financing and procurement across the republics ceased to exist. This led to a complete collapse of the demand driven by the defense industry. As a consequence, a lot of people had to change their lifestyles. At that time, the first independent, privately owned suppliers of electronic components appeared on the market to supply spare parts and subsequently triggered a change in the distribution model, which gave birth to many prominent distributors we know in modern Russia.

After the breakdown of the USSR in 1991, the situation changed dramatically. Borders were established between ex-Soviet republics and centralized financing and procurement across the republics ceased to exist. This led to a complete collapse of the demand driven by the defense industry. As a consequence, a lot of people had to change their lifestyles. At that time, the first independent, privately owned suppliers of electronic components appeared on the market to supply spare parts and subsequently triggered a change in the distribution model, which gave birth to many prominent distributors we know in modern Russia.

The domestic connector industry, left over from the Soviet era, went through a tough period and was faced with heavy losses as the demand for their connectors decreased significantly. All the manufacturing plants reacted by laying off employees and trying to diversify their businesses. Some of the plants managed to transform themselves into corporations and became private companies. Others remained state-owned plants. Nevertheless, practically all connector manufacturers in the Russian Federation survived the demise, and starting in 2007, when the government decided to start supporting the electronics industry, a tangible growth of revenues became reality.

Today, 10 main companies (with a total staff of 10k+ employees) in the Russian Federation manufacture connectors as their core business. The total turnover of these 10 companies in 2012 is estimated at $185M.

Other Russian companies produce connectors, but mostly for their own internal consumption/end products. One such company is Istok, a well-known manufacturer of UHF military systems.

Russia’s connector manufacturers include:

- Atlant is a manufacturer of rectangular connectors for automotive applications, located in the south of Russia.

- Elecon is a leading manufacturer of circular connectors, located in the center of the Volga region.

- Electrodetal is a leading manufacturer of rectangular connectors for industrial and telecom applications, and is located in the central part of Russia.

- Electrosoedinitel, the subsidiary of Elecon in Soviet times, became an independent manufacturer of circular, rectangular, and RF connectors.

- IRZ is the largest manufacturer of electromechanical components (relays and switches), with no less than 15% of revenue accounted for by circular and rectangular connectors. It is the only company located in Siberia.

- Iset is one of the largest manufacturers of circular and rectangular connectors. Optical, RF connectors, and IC sockets are also part of the product range. In 2006 the company started working with SOURIAU. Iset is located in the Urals region.

- Kaskad, located in the south of Russia, is a manufacturer of rectangular connectors for industrial and telecom applications.

- Kopir is a manufacturer of circular and rectangular connectors, including automotive connectors, located in the center of the Volga region.

- Sneget, in Soviet time a subsidiary of Electrodetal, later became an independent manufacturer of rectangular connectors (two types in production program).

- Soedinitel is the only company founded in post-Soviet time (1993) with specialization in heavy-duty and application-specific circular connectors. It is located in the Urals region.

More recently, attempts were made to consolidate the majority of these connector manufacturers, with the exception of IRZ, Kaskad, and Soedinitel, and bring them under the control of the state-owned holding Radioelectronic Technologies, which is in turn part of Rostech. Since 2009, Radioelectronic Technologies has been led by Nikolay Kolesov, who was the CEO of Elcon in the 1990s, and controlled various other companies as well. Kolesov has ample experience with connector manufacturing, but the real problem is that the connector manufacturers concerned are not keen on losing their independence.

The biggest problem for domestic manufacturers in the Russian Federation, and the connector industry is no exception, is their low productivity levels. The average TP-index (Turnover-to-Personnel) for these 10 Russian connector manufacturers is on the order $17K. In comparison, the TP-index of international connector manufacturers like Amphenol or Molex is at least five times greater.

As described above, privately owned electronics manufacturing in Russia started only after the disintegration of the Soviet Union and was highly dependent on distributor channels. From the early 1990s onwards, niche distributors like Brown Bear and stock distributors like Platan, Promoelectronica, and Symmetron created the open Russian connector market. All these started by importing connectors from Taiwan and China, and only in recent years achieved the status enjoyed by franchised distributors of world-leading connector manufacturers like Amphenol, Molex, and TE Connectivity.

As described above, privately owned electronics manufacturing in Russia started only after the disintegration of the Soviet Union and was highly dependent on distributor channels. From the early 1990s onwards, niche distributors like Brown Bear and stock distributors like Platan, Promoelectronica, and Symmetron created the open Russian connector market. All these started by importing connectors from Taiwan and China, and only in recent years achieved the status enjoyed by franchised distributors of world-leading connector manufacturers like Amphenol, Molex, and TE Connectivity.

Today, nearly 80 foreign connector manufacturers are represented on the Russian connector market via local or global distributors or direct sales. At least 20 of them have their own subsidiaries in Russia. Despite their presence, a substantial share of the Russian connector market is in the hands of obscure manufacturers from Asia. The DTAM (Distributor Total Available Market) of the Russian connector market in 2012 was estimated at $300 million.

So what are the two faces of the Russian connector market? First of all, the electronics industry in Russia is separated into two large segments:

- “State electronics,” with a focus on military and space applications and the nuclear energy sector

- “Civil electronics,” with a focus on industrial applications and the automotive, data processing, consumer, telecom, and transport sectors

The state electronics segment had been stagnant since the mid-1990s, but grew rapidly in the last five years due to massive state investments. The market for civil electronics shows quite the opposite picture – this segment experienced double-digit growth after the economic liberalization in the 1990s, but growth has stalled since the 2008-2009 financial crisis. Some experts estimate the current proportion of the state-owned electronics market versus the privately owned electronics market as 40/60.

This “two-faced” situation is reflected in the Russian electronic components market. The authorities running the state electronics sector introduced the term “electronic component base” and use it in all official documents in order to differentiate themselves from the civil electronics counterparts that use the less powerful term “electronic component.” This terminology has a strong meaning in the Russian language and suggests a preference of components for “state electronics” over “inferior” components used in “civil electronics.” As a result of this recent trend, distributors involved in the state electronics business presented much better results in 2012 than those involved in the civil electronics business.

In the context of this historic background, it becomes a little easier to understand what moves the electronic components market in Russia and, therefore, the Russian connector market. It is a complex situation and to make accurate estimates of the total market volume and/or the accessible market volume is a very difficult, if not impossible, exercise. It is clear that there are market opportunities for foreign and domestic connector manufacturers but the odds may sometimes be against you and sometimes be in your favor. Let’s hope that Russia’s admission to the WTO will eventually turn things around and, as some experts believe, create an investment boom in the electronics industry that turns the Russian electronics market into a lucrative place for doing business.

By Arthur Visser, Bishop & Associates Inc., and George Kell, Electronics World Ltd.

- The Industrial Market for Connectors in a Changing World - April 20, 2021

- How Key Trends in the Transportation Market Will Impact Electronics Growth - March 17, 2020

- Automation Means a Bright Forecast for Industrial Connectors - February 19, 2019