How Key Trends in the Transportation Market Will Impact Electronics Growth

Safety, efficiency, and environmental impact are three key trends driving the selection of electronic components and systems deployed in new transportation industry applications.

The non-automotive transportation market includes most vehicles and forms of transportation, except for passenger cars, light trucks, and vans. Each of these forms of transportation is designed and engineered to best suit the medium in which it operates: rail, road (on- and off-road), air, or sea. On one hand, the transportation market is a very diverse market segment that includes vehicles ranging from huge oil tankers, rolling stock and locomotives, heavy trucks, and construction machinery to commercial jets, warehouse equipment, golf carts, and farm tractors. On the other hand, these very different vehicles have several things in common:

- They are made to carry and/or move people or payload.

- They have a form of propulsion and are powered by an engine or motor.

- Until recently, nearly all non-auto vehicles used fossil fuels as their main source of power.

- In the past decade, designers of non-automotive vehicles have reviewed conventional propulsion systems and have started using newer, cleaner technologies for generating power.

Transportation applications typically require very high quality — and therefore sometimes costly — connectivity solutions due to their critical nature (safety) or their complexity. Applications in commercial aviation and in critical systems onboard ships or rolling stock often have a lower annual volume in terms of units produced but a higher unit cost. Less critical applications, like trucks and recreational vehicles, are often characterized by a higher annual volume and a lower unit cost.

Transportation Market Trends

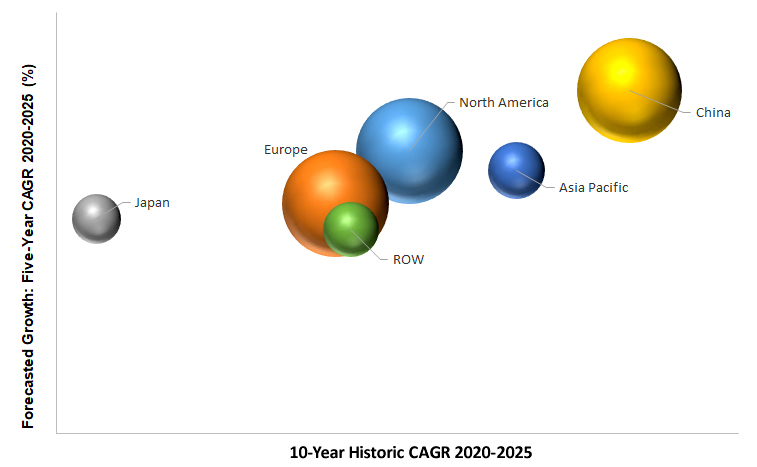

In the following graph, the relative size of the connector market within the transportation sector in each region is represented by the size of the bubble. The average annual compound growth rate (CAGR) of each regional market over the past 10 years (2009–2019) is plotted on the x-axis and the forecasted five-year CAGR (2020–2025) is plotted on the y-axis. This graph shows that the Chinese market is poised to outgrow all other regions. As a result, China will become the leading transportation market for connectors in the coming years. North America and Europe are almost equal in size, but the North American transportation market for connectors is set to outpace the European market during the forecasted period. Japan has been lagging behind.

Safety, efficiency, and environmental impact are the three key trends that will drive the selection of electronic components and systems deployed in new transportation industry applications in the coming years. Regulation and standardization are significant factors that impact the transportation industry. Many recent rules and regulations are related to safety and environmental requirements. Most governments, especially those in Europe, Japan, and North America, have set standards for clean air, which impact every vehicle that releases emissions into the atmosphere. China has also started to implement similar requirements. To meet these environmental standards and requirements, engine technology will have to change, which will drive the early replacement of vehicles with older, non-conforming engines. To meet enhanced safety requirements, newer technologies that allow operators to detect potential problems at an earlier stage will be implemented. To meet increasing efficiency demands, technology designed to make transportation more efficient will be added as well.

Air

The aviation sector is experiencing significant disruption in terms of new aircraft deliveries, and thus operational problems, as a result of the Boeing 737 MAX groundings. Disruption to travel as a result of COVID-19 will further impact this sector. In addition, some countries are seeing social movements that promote reducing air travel to reduce the carbon impact on the environment. At the same time, the industry itself is introducing more sustainable aviation fuel, such as the effort led by the Business Aviation Coalition for Sustainable Aviation Fuel (SAF Coalition). New technologies, including communication networks and navigation equipment, are finding their way into aircraft, while other flying crafts, such as air taxis and/or drones, are making their way to the marketplace, ready to be commercialized. The adoption of new technologies and products in the aviation market is usually slow compared to other industries, due to extreme safety concerns and the high degree of regulation and certification in the aviation industry.

Sea

The commercial marine industry is also subject to rules and regulations that regulate safety-related systems and environmental impacts. New ships have to comply with more stringent emission standards and existing ships may have to be retrofitted with cleaner engines or systems that filter their emissions. The International Maritime Organization imposed new emissions standards on January 1, 2020, to significantly curb pollution. As far as recreational boats are concerned, several lakes in Europe, such as Lake Como in Italy, and in the U.S. (governed by state regulations) only allow electric-powered boats. In addition, on a macro-economic level, world trade also influences the commercial marine market. With world trade and world GDP growth slowing, new orders will potentially be postponed or not issued.

Rail

The rail sector often looks toward government support when it comes to building the infrastructure for high-speed rail lines and passenger services. This is primarily due to the fact that expansion and modernization is extremely capital-intensive. Today, many countries and regions, including Europe, China, India, and Japan, continue to invest heavily in rail infrastructure. These investments are often driven by governmental directives, such as emissions requirements like the European Directive 97/68/EC for engines used in new non-road mobile machinery, Environmental Protection Agency (EPA) regulations in the U.S., or similar emission standards in China or Japan. Other times, modernization includes the implementation or adaptation of new detection, warning, or collision prevention systems used on- and off-track. The drive to increase ridership through enhanced passenger comfort and entertainment features also plays a role in the expansion and modernization of today’s rail system.

Road

In the passenger bus sector, and especially in larger cities within Europe, North America, and China, there is a strong drive to switch to electric buses. But the reality is that, as of 2019, 99% of electric buses on the road were in China. This corresponds to about 17% of China’s total bus fleet, or a little more than 421,000 buses. In comparison, there were only 2,250 electric buses on the road in Europe and only about 500 in the US. For the medium- and heavy-duty truck segment, the switch to electric-powered vehicles is even slower than for the passenger bus segment due to specific issues related to trucking, such as long-distance routes and additional battery weight. For these trucks, alternatives such as natural gas and hydrogen fuel cells may prove to be more suitable. In an examination of the key transportation sectors, the impact of regulations may be the toughest for road vehicles.

Transportation Technology and Connectivity

Another aspect that ties all of these forms of transportation together is that data networking has become an essential part of managing and controlling fleet and system operations, meaning that each now employs a data bus. Road vehicles often feature CAN-Bus-compatible or SAE J1939-based networks. ARINC 429 is the dominant data bus used for commercial airlines, but the Boeing 777 features the faster ARINC 629 bus and the Airbus A380 uses full-duplex switched Ethernet (AFDX), which is an implementation of deterministic Ethernet defined by ARINC Specification 664 Part 7. NMEA 2000, which is based on SAE J1939 and standardized as IEC 61162-1, is a plug-and-play communications standard used for connecting marine sensors and display units within ships and boats and is electrically compatible with the CAN Bus used on road vehicles. The Train Communication Network (TCN) used in most modern train control systems consists of a hierarchical combination of two fieldbuses for data transmission within trains — the multifunction vehicle bus (MVB) module inside each vehicle or carriage and the wire train bus (WTB) used to connect the individual vehicles or carriages — and its components are standardized in IEC 61375.

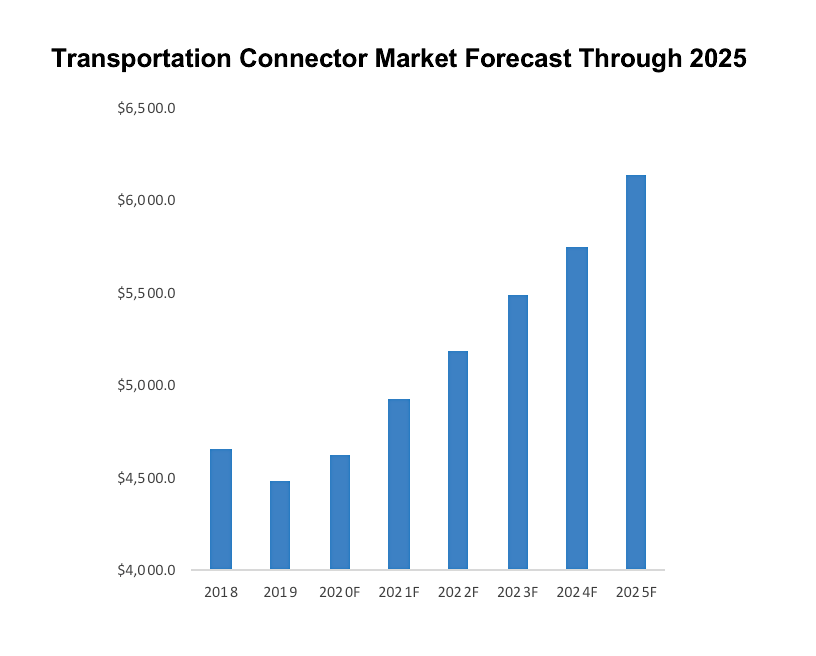

Connector consumption in the transportation market sector reached nearly $4.5 billion in 2019, a decrease of 3.8% over 2018, which is primarily a result of a slowdown in the world economy. The decline was not the same across all subsectors, nor is the $4.5 billion evenly distributed across all modes of transportation. Several subsectors, such as commercial marine and rail, performed better than others. At the same time, connector consumption within each subsector varies greatly, with commercial vehicles representing the largest portion of connector consumption and RV and power sports representing the smallest portion. Continued adoption of technologies that will allow manufacturers to comply with new rules and regulations regarding emissions and safety requirements, as well as a need to meet efficiency demands and provide an enhanced user experience, will guarantee further growth for connector manufacturers in this market.

More information about the non-automotive transportation market, including a detailed forecast by subsector and region and an examination of connector types used within each subsector can be found in our new 10-chapter report, Non-Automotive Transportation Market for Connectors (M-4100-20).

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

Like this article? Check out our other Industry Facts & Figures, market update, and forecast articles, our Transportation Market Page, and our 2020 and 2019 Article Archives.

- The Industrial Market for Connectors in a Changing World - April 20, 2021

- How Key Trends in the Transportation Market Will Impact Electronics Growth - March 17, 2020

- Automation Means a Bright Forecast for Industrial Connectors - February 19, 2019