Rise of the Industrial Robots

Rise of the Industrial Robots

Rise of the Industrial Robots

When Hon Hai Precision Industry Company Chairman Terry Gou announced in 2011 that Foxconn, its wholly owned subsidiary, would install one million robots over the next three years in its factories to replace workers and do “simple” work, he probably did not actually intend to install that many industrial robots in such a short period of time. Perhaps his intention was to counter the bad press the company was receiving at that time about its labor conditions. But in reality, Foxconn has been building its own robots, called Foxbots, for many years and publicly demonstrated the first Foxbot in 2006. A complete range of Foxbots exists now, all built in-house for in-house use, which means they do not show up in robot sales statistics. Currently, all of them are designed to perform fairly simple, repetitive, tasks.

So, Gou’s announcement was not unrealistic, as robots had already claimed a prominent position in the company’s factories. Foxconn is one of the world’s largest manufacturing companies in the electronics industry, producing an estimated 40% of the world’s consumer electronics equipment. That underscores the significance of the announcement to replace workers with robots; many people would be affected by the decision.

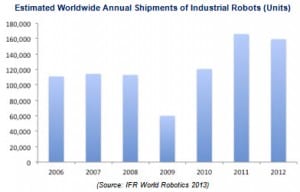

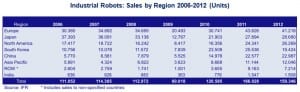

In 2012, an estimated 159,346 industrial robots were sold, a 4% decrease from 2011. This decrease was mainly attributed to a decrease in sales to the electronics industry. Markets in Japan, China, US, Korea, and Germany were responsible for 70% of global industrial robot sales.

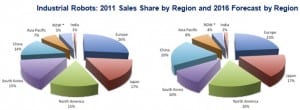

The market for industrial robots is now poised for further growth. By 2012, China had already become the world’s third-largest single market for industrial robots, but only counted 20 robots for every 10,000 workers. Compared to Korea, Germany, and Japan, where there is a ratio of 270 to 400 robots for every 10,000 workers, the potential for growth is clear.

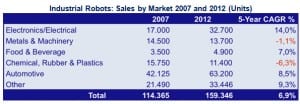

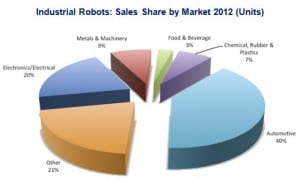

In 2012, the automotive industry was still the most important sector for industrial robots, followed by the electronics/electrical sector. Over the five-year period between 2007 and 2012, the use of industrial robots in the electronics/electrical equipment market — a market in which Foxconn is the leading manufacturer — has recorded the highest compound average growth rate, at 14%. Next is the automotive sector, with a CAGR of 8.5% and in third place the food and beverage market, with 7.0%. The “others” market has grown by 9.3%, but this number cannot be split by end-use equipment. Two markets have seen a decline in the sales of industrial robots, the metals and machinery market and the chemical, rubber, and plastics market.

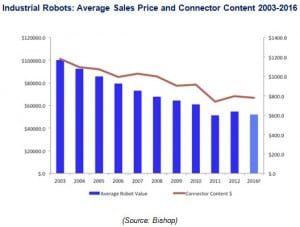

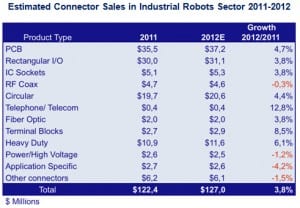

While the sales of industrial robots have increased over the years, the average price per robot has decreased, except in 2012, when the average cost per robot appeared to have been slightly above the 2011 levels. This is why total sales in 2012 were higher than in 2011, despite smaller sales in units. At the same time, the connector content has not decreased over the past years, but has followed a similar trend as the robots, decreasing slightly in value. If 2012 marked a halt in the overall price reduction, and if the forecast for 2016 is correct, we’ll see the average price per industrial robot level off, at least for the next couple of years.

For connector manufacturers that serve this market, the connector potential is poised to grow. While communication/interaction between robots and their environments is becoming increasingly important, and cabling and connectivity are still major issues when designing industrial robots, there are opportunities for connector manufacturers with innovative products and solutions. As the average lifetime for industrial robots is eight years, the replacement market will also develop and grow each year.

The IFR estimated that by the end of 2012, the total worldwide stock of operational industrial robots was in the range of 1.23 to 1.5 million units. Of course, the rise of the robots doesn’t end here and is not limited to industrial robots.

For example, the US military expects to have 10 operational robots for every soldier by 2023. These robots could perform tasks such as carrying gear, following foot soldiers on long treks, scanning for land mines, and carrying wounded soldiers to safety. Robotics companies such as Northrop Grumman, HDT Robotics, iRobot Corp., and QinetiQ are also developing armed robots for the US military that will be capable of delivering substantial firepower. These robots can be operated by a nearby soldier but also via satellite radio communications, from hundreds of miles away.

Service robots are split into professional service robots and robots for personal use. The latter are found mainly in the areas of domestic (household) robots, which include vacuuming, floor cleaning, and lawn-mowing robots, and entertainment and leisure robots, such as toy, hobby, education, and research systems. Professional service robots may include robots for medical use; for scientific research; for underwater jobs; for logistics; for cleaning, construction, and demolition tasks; and for agricultural tasks.

There were literally millions of domestic service robots sold worldwide in 2012. Professional robots are sold in much lower quantities, at about 16K units in 2012. However, add up all these different types of service robots, including industrial robots, and there were well over 3.2 million robots sold in 2012. It is clear that robots are on the rise, and in the future we may see factories filled with robots instead of workers.

Arthur Visser, VP, Bishop & Associates, Inc.

- The Industrial Market for Connectors in a Changing World - April 20, 2021

- How Key Trends in the Transportation Market Will Impact Electronics Growth - March 17, 2020

- Automation Means a Bright Forecast for Industrial Connectors - February 19, 2019