The Dynamic Server Market Reflects Ongoing Innovation in Computing

The size of computers has dramatically shrunk, from room-sized machines to tiny devices. But the power needed for web-based communications has made huge server facilities essential to support operations.

The computer server industry has undergone continuous technology shifts since its inception. We have come a long way from the IBM Automatic Sequence Controlled Calculator, known as Mark I, a room-sized proto-computing system with hundreds of vacuum tubes installed at Harvard in the 1930s. It weighed five tons and cost over $3 million in today’s dollars. This electromechanical machine could compute three addition or subtraction equations per second. Fifteen years later, the University of Pennsylvania’s Electronic Numerical Integrator and Computer (ENIAC) was still massive, but computational speeds had improved to 7,000 equations per second.

Advances in semiconductor technology in the 1970s and beyond enabled huge changes in every area of technology. The size of computing machines greatly diminished while their capabilities increased; today, the Summit supercomputer developed by IBM can handle 200,000 trillion calculations per second. Potential uses for computing devices emerged in every market and many more entities became involved in the development of computer equipment. Along the way, a large number of computer and PC OEMs failed, including DEC and Data General. The arrival of the internet accelerated innovation in computing products and consumers gained access to previously inaccessible technologies. The web gobbled up new digital communications and the traditional telecom industry would never be the same. Today, mainframes and supercomputers continue to provide computing power and storage, and the need for these services has escalated with the skyrocketing proliferation of mobile devices. Wired networks gave way to wireless, which went through its own hiccups until Ethernet emerged as the winner. Through all this change, the connector industry proved to be very resilient and innovative, but not without pain in the ranks.

Then the dot-com bubble burst in 2000, taking with it scores of startups that had emerged during the early days of internet hype. After the sharp recession that followed, growth in web-based technologies accelerated. The internet came of age and the term server emerged to describe the equipment needed to automate internet transactions. Today, HP, Dell, IBM, Intel, AMD, Lenovo, Oracle, Supermicro, Compal, Quanta, and others offer various server designs, which include a specialized range of high-power and high-performance hardware. Clients for these applications include departmental, small business, large enterprise, data center, and institutional users. The server products they use depend on the type and size of their operations, and include micro-servers, blade servers, rack servers, tower servers, enterprise tower servers, servers contained within cloud and hyperscale data centers, (e.g. Open Compute), and hardened server designs for industrial and military applications.

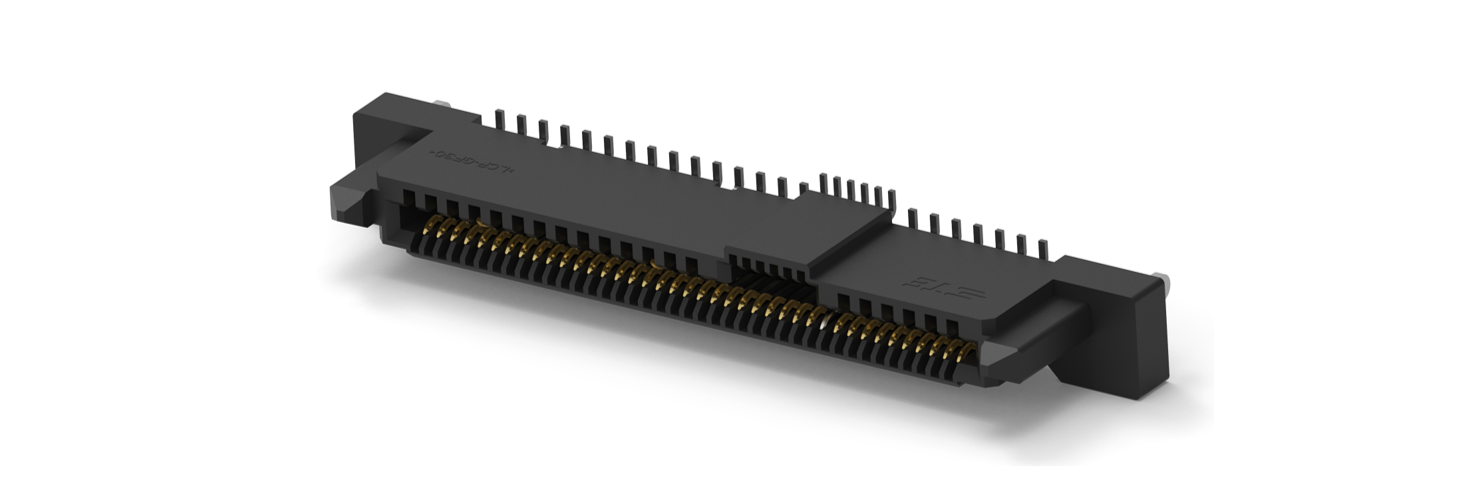

TE Connectivity’s 68-pin connectors for SAS/PCIe Gen 4 offer 24 Gb/s for SAS lanes and 16 GT/s for PCIe lanes. They can be used by cost-effective storage hard disk drives, higher performance server solid-state drives (SSDs), or high-speed PCIe production.

The server industry was heavily weighted to U.S. manufacturers, but that has changed. China now has companies like Inspur and Huawei, as well as U.S.-China joint ventures. Multiple contract manufacturers produce server boards and systems, some of which are private label products for U.S. server OEMs. Taiwanese original design manufacturers (ODMs) cut their teeth on motherboards, PCs, and laptops and then moved to more profitable servers. This has helped create the near-domination of X-86 servers, which employ Intel Xeon processors and lower-cost standard architectures. Intel has offered chipsets and design expertise, but that is now maturing.

Intel’s latest 3rd Gen Intel Xeon Scalable processors deliver a balanced architecture with built-in artificial intelligence acceleration, crypto acceleration, and advanced security capabilities.

A recent dynamic is hyperscale data centers, which contain more than 5,000 servers. These massive installations reportedly now number over 600 worldwide. This has encouraged data center operators to leverage ODM know-how into an ODM-direct marketplace, often cutting out name-brand OEMs in favor of lower cost and often self-designed, bare-bones server systems. Some of these data centers will employ Data-as-a-Service, or DaaS, which can supplant in-house computers so long as latency is addressed with co-location — locating server facilities near the customer.

The worldwide server market will exceed $100 billion in 2021. According to IDC, HPE, Dell, and Inspur lead in OEM dollars and volume. Taiwanese ODMs, including Quanta, Wiwynn, Foxconn, Inventec, MiTAC, ASRock, and Gigabyte, now hold over 30% of the total market, while HPE, Dell, and IBM hold around 34%. HPE has H3C, IBM, and Inspur JV in China. So, from a market standpoint, it appears the major trends are:

- Continued penetration of ODM direct, although unknowns remain about outsourcing amid tensions with China

- Possible preemptory technology moves by OEM leaders or Intel centered on Session Initiation Protocol (SIP) technology, IC system-in-package (IC SiP), and silicon photonics

- Watch data centers leverage DaaS to increase penetration over traditional OEM offerings

Server Connectors

Connectors used in servers run the gamut, from processor and DRAM Memory Sockets to HDD/SSD card edge and PCIe, to power and various I/O connectors, including RJ45, USB 3.0, VGA, LC, and MPO fiber. The motherboard includes even more; a typical list includes:

- 2 LGA3647 connectors

- 2 PCI 3.0-16 connectors

- 8 PCI 3.0-6 connectors

- 1 PCI 3.0-4 M2 connector

- 16 DDR4/DIMM connectors

- 2 SATA-3 connectors

- 2 Power connectors

- 2 RJ45 10bT connectors

- 2 VGA connectors

That’s 37 total server connectors, plus numerous cables and cable assemblies.

Amphenol ICC’s DDR4 DIMM Sockets facilitate convenient memory expansion in servers, workstations, desktop PCs, and embedded applications in communications and industrial equipment.

Today’s accelerating server trends include I/O port fiber and single-mode fiber, waveguides, silicon photonics integrated circuits, and packaging technology. The server and data center markets will probably undergo technology changes related to silicon photonics and circuit consolidation via 2 nanometer (2nm) chip technology, system-in-package, and lightwave system packaging.

To learn more about the server market’s performance in 2020 and see an anticipated forecast for 2020-2030, see the Bishop & Associates report, Computer Server Market Trends and Connector Use 2020-2030. This report discusses the current trends driving server growth and the manufacturers participating in this growth. Also examined are the connectors used in servers, including which connector types will experience the most growth and which will slowly be phased out.

To learn more about the server market’s performance in 2020 and see an anticipated forecast for 2020-2030, see the Bishop & Associates report, Computer Server Market Trends and Connector Use 2020-2030. This report discusses the current trends driving server growth and the manufacturers participating in this growth. Also examined are the connectors used in servers, including which connector types will experience the most growth and which will slowly be phased out.

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

- Electric Vehicles Move into the Mainstream with New EV Battery Technologies - September 7, 2021

- The Dynamic Server Market Reflects Ongoing Innovation in Computing - June 1, 2021

- The Electronics Industry Starts to Ease Out of China - November 3, 2020