Desktop Roundup: Everything’s Different Now

The PC market has experienced significant change over the past decade, and will change even more so in the years ahead.

The PC market has experienced significant change over the past decade, and will change even more so in the years ahead.

This will impact electronic component and connector sales in desktop PC-related market segments: PC motherboards are changing, all-in-one desktop designs are on the rise, peripherals and cabling will be influenced by new high speed IOs, and instant-on capability will be added with SSDs (solid state drives).

PCs have evolved over the years into much more user-friendly, powerful, and distinctly more mobile machines. Over the past decade, PCs have transitioned dramatically towards laptop/notebook designs, leaving the original desktop tower design to entry-level, legacy, or power users. Many factors contributed to this change, not the least being that notebooks came down in price to compete directly with desktops. In addition, notebooks got more powerful with better battery life and ubiquitous WiFi connectivity. Liquid crystal display (LCD) screen resolution improved to high definition (HD), and PCs in general became world products, experiencing rapid growth in developing nations.

Most recently, PC manufacturing gravitated to Asia, and outsourced manufacturing to PC and motherboard assembly specialists in Taiwan and China. Brutal price competition, caused in part by the PC’s increasing commodity status, resulted in years of industry shake-out that has left fewer than 10 major suppliers worldwide as of 2012 — a situation not dissimilar to what has happened to the hard drive market. Second-tier and “white box” suppliers remain for the retail and hobbyist market, and a few gaming PC suppliers remain.

Apple re-emerged with its blockbuster products, including the iPod, iMac, and MacBooks. Apple’s performance was bolstered by a bold switch to Intel processors in 2005. This decision, along with product developments including the iPhone and iPad, has transformed Apple into the most valuable company in the industry, based on its current market capitalization of more than $500 billion. Tim Cook’s $378 million total income in 2011 topped all industry executives. Apple reinvented the desktop as well as the notebook with its aluminum-cased MacBook, and the ultralight with MacBook Air. This has been recently followed by Intel’s Ultrabook concept. Thus, the PC market has continued to expand outward with an ever-higher degree of fragmentation. This has benefited and taken away from traditional desktops, cannibalized other market segments, and even changed connector requirements

Electronic Publishing: World at Your Fingertips via PC

Electronic Publishing: World at Your Fingertips via PC

Perhaps an equally important development was the emergence of a world of innovative third-party applications for these devices. Tablet PCs had been around for years, but they were force-fitted into Windows and never took off. Apple reinvented the tablet with iPad’s introduction in January 2010. This created a whole new category of networked Internet appliances and has taken some of the steam away from notebook and desktop PCs, particularly in the consumer market. But it won’t end there. As of this writing, Apple has inked electronic publishing deals with major book publishers, including important school book producers such as Houghton-Mifflin-Harcourt and McGraw-Hill. Despite the recent imbroglio on supposed price fixing, this will change book publishing forever and will positively impact future PC sales to the education world. As always with these sea changes, there will be winners and losers.

Out of all this turmoil and exciting innovation, where does the desktop stand? What is its future? How will the industry replace the mega-volume products by the desktop PC-AT motherboard architecture? Or will desktops recover and move ahead with the rest of the extended PC marketplace?

The Present and Future of the Desktop PC

The desktop PC market evolved into a shared supply chain between Intel’s overarching CPU and box design, OEM PC manufacturers, and Taiwanese original design manufacturers (ODMs) who designed and build motherboards. These ODMs — such as Asus, Foxconn, Gigabyte, ASRock, Elitegroup, and others, along with display and hard disk drive (HDD) suppliers — make up the main component parts of a desktop PC. This promoted the ultimate modular/multivendor design of the typical PC tower: case, motherboard, hard drive, socketed CPU and DRAM, display, keyboard, and so on. Anyone with skills could assemble a PC. Michael Dell did it in a garage, as did Steve Jobs and many others. For 20 years that design concept, started by IBM, evolved into the present-day desktop PC. That PC design has now exploded into several different desktop categories:

- Power workstation or gaming PC

- Traditional tower

- Small tower

- Thin client

- All-in-one

- Modular/microcomputer

The packaging characteristics of these systems are different:

| · Workstation: | Similar to tower, higher performance, more DRAM slots and IO, socketed CPU and memory |

| · AT/tower: | Conventional PC mainboard and socketed CPU, 4-8 GB SDRAM, 500GB to 2TB memory |

| · ATX/small tower: | Downsized MB, socketed or direct-attach CPU, 2-4 GB SDRAM, 200GB-1TB memory |

| · Thin client: | Similar to above, fewer IOs, less memory, dependent on server applications and storage |

| · AIO PC: | Streamlined, low-mated-height custom mainboard, judicious with IO ports, sockets, or direct attach |

| · Micro-PC: | Mac Mini or Google Chrome designed “brick,” fewest connectors, small integrated logic board |

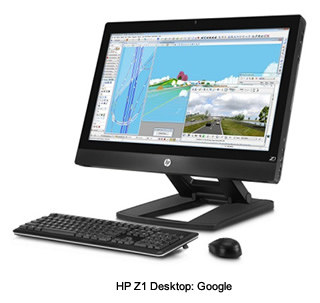

At this time, it appears the AIO PC will become the preferred design for several reasons:

-

Sleek design for upscale or limited workspace

-

Integral LCD display, typically 21-27 inches with touchscreen capability

-

Fewer external cables

-

No or little compromise in performance for most users

-

Can be boxed and moved from one location to another

The impact of this trend on the marketplace:

-

Decreases role of independent motherboard suppliers — or they become ODM/subcontractors

-

Reduces quantity and visibility of connector mainboard applications

-

Packaging and interconnect demands become more akin to full-size notebook designs

-

Has become a major business line for leading PC manufacturers

-

May limit the flight to notebooks, or at least stem the tide

-

Anticipate higher, workstation-level performance and AIO home entertainment centers in the future

| OEM Desktop Suppliers: | Motherboard Makers: | ||

| · Hewlett-Packard · Dell · Sony · Lenovo · Acer |

· Apple · Sony · Founder Group – China · Fujitsu (formerly Fujitsu- Siemens) · Systemax |

· ASUS · Gigabyte · ASRock · Elitegroup |

· Foxconn · Intel · MSI · FIC |

Where do we go from here?

All-in-one systems are the current rage in desktops, but they are challenged by several factors: cost, strong attraction to notebooks and UltraBooks, inexpensive external displays that can triple a notebook’s viewing capability and add major viewing flexibility. But we see the AIO system design as most popular going forward for those who want a desktop, many in concert with a laptop, tablet, or smartphone. In that scenario, the desktop becomes “home base.”

It is hard to predict this future because the PC market is so dynamic. In our crystal ball we see a miniature desktop like the Google Chrome box shown below or other “mini” integrated into a large-screen monitor or receiver. We also see some sort of desktop super-computer for the masses, certainly in education. This is well within the reach of existing desktop capability. There is also the strong likelihood that Apple, Samsung, and others will reinvent the TV as a wireless Internet home entertainment center. TVs with WiFi are already out; the next step will be with computing power tied to a fast broadband Internet connection (even though some of the first Internet TVs fell flat). Internet protocol television (IPTV) holds great promise for the future, and a morphed desktop may be its best form factor.

Connector Content

Traditional desktop connector content is dominated by the motherboard, which has an array of PC board connectors, including PCIe, SATA, LAN, power, IO connectors, and those associated with hard disk drives, CPU, SDRAM, and so on. On average, 25 to 35 connectors are associated with the desktop tower application — sometimes more.

As more systems go to AIO designs, packaging begins to take on notebook-like features: thinner, lighter, and perhaps, fewer connectors per system. AIOs may use SODIMM (small outline dual in-line memory module) sockets and in some cases direct-attached CPUs. In general, AIOs are less modular than the traditional tower, though HP has one outstanding modular/upgradeable AIO design. IO connectors now include HDMI, and in the case of Macs, Thunderbolt. New units have both USB 2.0 and 3.0 ports. SATA is the preferred HDD, and SSD drives and most units have a multi-card reader. Intel remains a strong influence on desktop design, though the trend toward AIO has fragmented this design area.

Going forward, it will be interesting to see if the DisplayPort/Thunderbolt design leaks over into the desktop PC environment. Typically, Taiwan ODMs are most likely to innovate with new standards. Despite WiFi and Bluetooth, computer cables remain. The biggest culprit, if you will, is the power/transformer cable, which can get warm, and which, if you have several PCs, begins to cause cable clutter. One nice thing about AIOs is that you may only need one power cable for the PC and display.

We think the connector trend is as follows:

-

More thin surface-mount designs

-

Tradeoffs to the traditional socketed DRAM and CPU and higher performance as chips move forward from Ivy Bridge to 22nm and 18nm technology

-

Semiconductor technology and Intel’s continuing influence will prevail

-

Microsoft Windows 8 may be a boon to 2013 demand

See photos below:

- Electric Vehicles Move into the Mainstream with New EV Battery Technologies - September 7, 2021

- The Dynamic Server Market Reflects Ongoing Innovation in Computing - June 1, 2021

- The Electronics Industry Starts to Ease Out of China - November 3, 2020