Automotive Market Accelerates

Automotive Market Accelerates

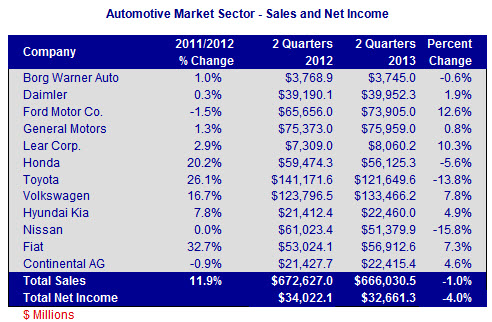

Bishop tracks 13 market sectors for electronic interconnects sales trends. The combined annual revenue of all the market sectors was $4.3 trillion in 2012 and grew 4.9% over 2011. Of the 13 market sectors, the automotive market was the fastest-growing sector in 2012 at 11.9% year-over-year with combined revenues of $1,338 billion. Profitability was $71.3 billion at 5.3% of sales.

Bishop tracks 13 market sectors for electronic interconnects sales trends. The combined annual revenue of all the market sectors was $4.3 trillion in 2012 and grew 4.9% over 2011. Of the 13 market sectors, the automotive market was the fastest-growing sector in 2012 at 11.9% year-over-year with combined revenues of $1,338 billion. Profitability was $71.3 billion at 5.3% of sales.

For the first half of 2013, Ford had the largest increase in sales at 12.6% year-over-year. Its growth in wholesale volume of vehicles was up 16% in Q2 and sales were up 15%. Revenues in North America were up 16.7% in the first half while revenues were up 12.8% in South America. European revenues were flat year-over-year and Asia Pacific was up 21.7%. Ford produced 49% of the vehicle volume in North America in Q2, 24% in Europe, 19% in Asia Pacific/Africa, and 8% in South America.

Lear Corporation has the second-highest growth in the first half, with sales up 10.3% year-over-year. Lear manufactures seats and wire harnesses for the automotive industry. Sales were up 6% in North America, 13% in Europe/Africa, 15% in Asia, and 50% in South America. In 2Q13, Lear had 39% of its business in Europe/Africa, 38% in North America, 17% in Asia, and 6% in South America. Seating represents 75% of Lear’s overall business.

Volkswagen grew 7.8% in the first half of 2013 over 2012. Through 3Q13, sales were up 9.2% in North America, down 2.5% in Western Europe, down 2% in Central and Eastern Europe, down 9.4% in South America, up 16% in Asia Pacific, and up 15.6% in the rest of the world. China and Western Europe are its largest markets.

Fiat’s sales grew 7.3% in the first half of 2013. Sales were up 5% in North America, up 8% in Latin America, up 46% in Asia Pacific, and down 3% in EMEA. In 2Q13, North America represents 52% of Fiat’s sales, EMEA represents 21%, Latin America 13%, and Asia Pacific 5%. Luxury/performance brands and components account for 9% of the sales.

Toyota and Nissan suffered poor results, contracting 13.8% and 15.8% year-over-year, respectively. Their problems are largely tied to the economic stagnation in Japan, the negative effects of a strong yen on exports, and lingering effects of the 2011 disasters.

The following table shows the results for the 12 companies we track in this market sector.

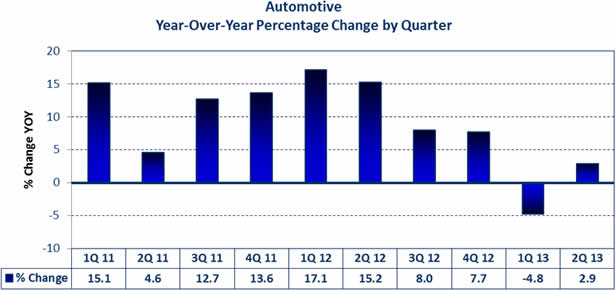

As can be seen in the following chart, year-over-year sales contracted in 1Q13, but have subsequently recovered. Sequentially, second quarter 2013 sales increased 6.1% from the first quarter of 2013.

Trends in the Automotive Industry

- The automotive market sector is a bellwether for the economy. Typically, when automotive is doing well, so is the regional economy to which it is tied.

- North America and Asia Pacific automotive markets have been growing the last three years, which has helped these economies. The European market for automotive is expected to return to growth in 2014. This will help the European economies expand.

- In a strong automotive market, updating and expansion of the production lines means more cable assemblies required to operate robotic systems and welding equipment. Additional mold and stamping presses are also required to produce parts, and this equipment also uses cable assemblies.

- The use of aluminum wire in automotive wire harnesses continues to grow as the automotive manufacturers reduce weight in the vehicles to improve gas mileage and reduce greenhouse gases. Aluminum wire and compatible connectors will require wire harness manufacturers to learn new assembly techniques and quality-check methods to successfully manufacture the product.

Bishop & Associates projects the worldwide market for automotive cable assemblies to grow 4.5% in 2013 to $34.2 billion. At 16% year-over-year growth, ROW will be the fastest-growing region in 2013 for this market sector.

- The Outlook for the Cable Assembly Industry in 2021 and Beyond - May 18, 2021

- A Data-Hungry World is Driving Demand for Wireless Connections - January 26, 2021

- Innovation and Expansion Drives Growth of Global Cable Assembly Market - May 7, 2019