The Future of Copper 40-Gigabit Ethernet

The first standard for 40G structured cabling, IEEE 802.3ba, only covered fiber optics and short-reach copper twinax. Now an active task force is developing a copper twisted-pair standard. Here is a look at the technology and potential market for copper 40-Gigabit Ethernet.

While the TIA touts its premise wiring standards as “application non-specific,” the industry at large understands that it really means Ethernet cabling. And, while copper has driven the structured cabling market revenue since its inception, the IEEE has focused its efforts on fiber and short-reach twinax cabling standards development ever since Gigabit Ethernet came along. This was the case again at 40/100G, where IEEE 802.3ba was released in 2012, without a “BASE-T” variant. We are just now seeing 40GBASE-T being developed. The main reasons continue to be the same:

- Higher data rates hit the higher network levels first (core and aggregation versus access), so are more inclined to be fiber first.

- Digital signal processing chip development used with twisted-pair copper is perceived to be arduous and time-consuming.

In fact, at 40G, even some network equipment manufacturers (NEMs) were reluctant to support a copper twisted-pair (TP) solution at all. Yet, somehow, here we are with a new standards project.

The 40GBASE-T standard’s main objective is to define a link segment based upon copper media specified by ISO/IEC JTC1/SC25/WG3 and TIA TR42.7 to meet the following characteristics: four-pair, balanced TP copper cabling with up to two connectors and up to at least 30m. This is a drastic reduction in both number of connectors and length of channel from 10GBASE-T, which are four connectors and 100m; however, much longer than the twinax cable solution for 40G, which is 7m. There were several reasons behind the change from 100m to 30m. First, the 10GBASE-T 100m cable ended up being too bulky and its driving electronics were too power-hungry, both of which delayed its adoption. Second, the first target market for this cabling is the data center and many analysts have shown that the average length in data center cabling is less than 50m, with the majority of copper TP cabling being less than 30m.

The cables that have the potential to meet the IEEE requirements are Category 7, Category 7A, and Category 8, which is currently being developed. The twinax solution and the Category 7A solution are shown below for comparison.

Figure 1: FCI’s QSFP+ 40GBASE-CR4 Cable Assembly

Figure 2: Nexans’ Category 7A Solutions (Horizontal Cable, Shielded Jack, Patch Cord)

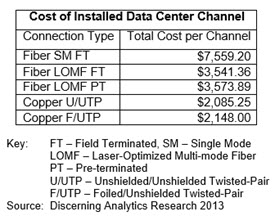

While the twinax product is a cable assembly designed primarily for an in-rack switch-to-switch or switch-to-server connection, the structured cabling solution has the traditional patch cords for server-to-patch panel and patch panel-to-switch, and horizontal cable running from patch panel to patch panel between racks. Many data centers and telecommunications rooms (TRs) still use this TP copper between racks, but these connections are moving increasingly to fiber, especially within the data center. Still, for those data centers that use end-of-row (EoR) versus top-of-rack (ToR) switching, 30m of TP copper cabling could save a significant amount of money over even a short-reach optical solution. A cost comparison of installed links at 10G is shown in the following table.

Each channel consists of 100m of the media type, including patch cords. It is based on installed switch ports that contain either optical or copper transceivers on two Cisco Catalyst 6509 EoR switches to fill a rack. It includes all labor. An image of a copper example of this is shown below. For more detail on the cost model, contact Discerning Analytics, LLC.

At 40G, the cost difference could be significantly more. However, it needs to be noted that data center managers are moving to fiber connections for several other reasons:

- Latency: Nanoseconds for fiber versus microseconds for copper

- Lower power consumption at higher data rates: At 10G, the short-reach optical solution is below 1W, whereas the copper TP port is still around 3W.

- Smaller: Allows better airflow in raised-floor environments; for the same number of installed channels, a LOMF installation will barely fill a cable tray, whereas the equivalent copper one fills the tray.

- Higher port-density

- Longer reach: At 40G, copper is currently only 7m, while fiber is 100m for LOMF and 10km for SMF.

- Less weight in cable trays

- Not susceptible to EMI: At 40G, the copper TP will need to be shielded, which adds weight.

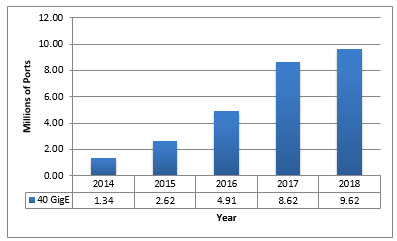

However, considering this cost scenario, it is easy to see why end users prefer copper connections and why the IEEE continues to support a “BASE-T” solution set. While it is still too early to determine how much of the 40G market may turn to 40GBASE-T, if history is any judge, it may be significant. Below is a volume market forecast for 40G ports over the next five years.

This year, more than 1.3 million 40G ports will be shipped. By 2018, that will rise to more than 9 million. Most, if not all, of these will be sold into the data center market and will be either copper twinax (40GBASE-CR4), short-reach fiber (40GBASE-SR4), or long-reach fiber (40GBASE-LR4 or shorter non-standard SMF MSA-based). By the end of 2017, we may start to see a few 40GBASE-T ports. This will be entirely dependent on whether the standard gets released on time (February 2016) and how power-hungry the new chips will be. As we have seen in the past, switch manufacturers will not adopt anything that has a power dissipation of more than 3W/port. Bishop & Associates remains cautiously optimistic about 40GBASE-T, but is still somewhat skeptical that it will be developed in time for its addressable market (less than 30m).

Lisa Huff, Market Director, Bishop & Associates, Inc.