Connector Manufacturers Sense Growth

As sensors increasingly work in tandem with connectors in IoT applications, some companies are expanding their expertise to encompass both of these elements.

Much like human eyes and ears, electronic sensors detect, measure, and report data on physical properties that enable electronic systems to react. Sensors of all types are proliferating as they become the critical link between conditions in the physical world and electronic equipment that utilize the resulting data to monitor and/or respond.

Much like human eyes and ears, electronic sensors detect, measure, and report data on physical properties that enable electronic systems to react. Sensors of all types are proliferating as they become the critical link between conditions in the physical world and electronic equipment that utilize the resulting data to monitor and/or respond.

Our world is festooned with sensors and many more are on the way. The ubiquitous smart phone packs up to 14 sensors, enabling advanced features such as high definition video, biometric ID, and face recognition. The automotive market represents one of the largest volume and fastest growing applications for electronic sensors. The typical car today utilizes sensors that quantify everything from the efficiency of the combustion cycle to the desired temperature of the passenger compartment. Dozens of other sensors manage the transmission as well as stand ready to instantly trigger an air bag if a collision is detected. Newer cars that feature driver assist functions add many more sensors, while fully autonomous cars will require a new class of internal and external sensors that must operate with extreme reliability in a wide variety of challenging environments.

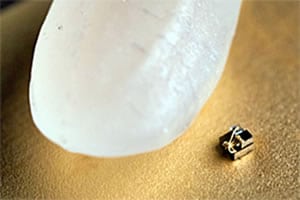

Multiple sensing technologies including optical, piezoelectric, magnetic, capacitance, ultrasonics, infrared, Hall Effect, thermoelectric effect, gravity detection, and GPS location are now incorporated in medical, industrial control, avionic, military as well as a host of consumer products. Demand for ever-smaller, low power components has spurred select semiconductor manufacturers to develop an expanding range of sensors based on microelectromechanical systems technology (MEMS). Sensor fusion takes this technology to the next step by integrating computing, storage, and communication capabilities. Applications once considered impossible have been enabled by sensing modules as small as 0.3mm. The confluence of advanced sensors, nearly unlimited computational power, and creative algorithms will enable an incredible array of new applications.

Multiple sensing technologies including optical, piezoelectric, magnetic, capacitance, ultrasonics, infrared, Hall Effect, thermoelectric effect, gravity detection, and GPS location are now incorporated in medical, industrial control, avionic, military as well as a host of consumer products. Demand for ever-smaller, low power components has spurred select semiconductor manufacturers to develop an expanding range of sensors based on microelectromechanical systems technology (MEMS). Sensor fusion takes this technology to the next step by integrating computing, storage, and communication capabilities. Applications once considered impossible have been enabled by sensing modules as small as 0.3mm. The confluence of advanced sensors, nearly unlimited computational power, and creative algorithms will enable an incredible array of new applications.

The Dawn of the Sensor Era

We are only at the opening chapter of the changes that the Internet of Things (IoT) will bring. Sensors will play expanding roles in the home (smart home), factory floor (Industry 4.0), hospital, on public thoroughfares, as well as in the electrical transmission grid (smart cities). The business opportunities that sensors present have not been lost on several manufacturers of connectors that are searching for new channels of sales growth.

Manufacturers of electronic connectors participate in a $60+ billion annual global business that has thrived over the past 75 years as electronics replaced mechanical systems and have become an integral element in the universe of modern devices. The connector industry has racked up years of solid growth and profitability driven by a continuous stream of new interfaces that offer higher current, bandwidth, packaging density, improved signal integrity, and durability.

Possible Headwinds for Connector Growth

Connector manufacturers may now be facing a series of evolving headwinds that could impact this historic growth rate. Connectors are fabricated using a variety of metals and plastics, making them vulnerable to swings in global market prices. Manufacture of connectors has largely shifted to Asia, raising questions about technology transfer and escalating wages. The impact of a potential trade war between the United States and China highlights this issue. Many standard connectors have become commodity products, wringing out profit. A series of environmental mandates promoted by the European Union have required the use of more costly materials and changed manufacturing processes.

The advantages of wireless interconnects continues to replace copper cable assemblies. Connector design engineers have been able to boost the bandwidth of copper connectors by optimizing every millimeter of signal path length, but we may be getting closer to the point where fiber optic alternatives may become a more cost-effective choice. Some of these factors may ultimately begin to put a lid on the historic growth curve of electronic connectors. Several connector manufacturers are responding by focusing their product mix on high performance and ruggedized connectors that offer greater margins. They also see good growth prospects in the estimated $93 billion global market for electronic sensors, and as a result, some large suppliers have expanded their sensor product lines.

Connectors + Sensors = Opportunity

At least 11 identified connector companies currently include sensors in their product lines. Leaders such as Amphenol and TE Connectivity have offered select types of sensors for years. What is new is their aggressive acquisition of fairly large, established sensor manufacturers to expand their offerings and increase their share of the total available market.

There is a logical link between connectivity and sensors that makes expanding their lines of electronic sensors an attractive proposition for connector companies. Many sensors are supplied with wire leads that are terminated with a connector.

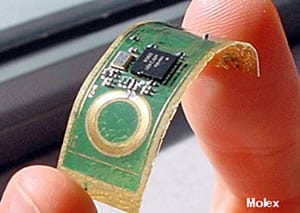

Connector manufacturers are able to leverage their internal discrete wire, flat flex circuit, and cable assembly resources. Rugged industrial and avionic sensors often incorporate a connector into the sensor itself.

Although sensors and connectors are often specified by different people within an OEM, a design-in opportunity for one may open the door to the other.

Equipment manufacturers often try to reduce their vendor base, making a connector supplier that can provide sensors an attractive option. Long-established relationships with the demonstrated ability to provide extensive technical support on a global basis can make a trusted connector and sensor supplier the preferred choice. Traditional sensor manufacturers range from very large global suppliers that may offer sensors as one part of an even larger product family, to very small sources that may specialize in one specific type of sensor or application. The result is a rapidly growing, highly fractured market that is ripe for consolidation.

Bishop & Associates has recently released a new market research report titled Connector Manufacturers Connect to Sensors. Report # P-770-18 features chapters that review the basics of sensor technology, defines the current leading suppliers of electronic sensors, details many of the burgeoning applications for sensors, explains the synergy between connectors and sensors, reviews emerging sensor industry trends, as well as provides detailed market estimates and forecasts of the global electronic sensor market, including five-year CAGR. Please visit the Bishop Store for more information.

Interested in a specific market? Click a market below for current articles and news.

Automotive, Consumer, Industrial, Medical, Mil/Aero, Datacom/Telecom, and Transportation

- Optics Outpace Copper at OFC 2024 - April 16, 2024

- Digital Lighting Enhances your Theatrical Experience - March 5, 2024

- DesignCon 2024 in Review - February 13, 2024