COVID-19: A Black Swan Event for the Connector Industry

The COVID-19 pandemic is disrupting supply chains, cooling demand, and affecting businesses in virtually all market segments. How will this impact the connector industry? History may have some clues.

A black swan event is defined as an extremely rare, unpredictable, and unexpected occurrence that has significant negative impact on an economy. The COVID-19 pandemic is such a black swan event.

There have been three other large viral outbreaks in the 21st century, two of which were also coronaviruses:

- Severe Acute Respiratory Syndrome (SARS-CoV): Between November 2002 and July 2003, this coronavirus outbreak originated in China with over 8,000 documented cases and 774 deaths in 17 countries. The fatality rate was 9.6%. No cases have been reported since 2004. SARS had no apparent impact on the connector industry, as sales were up +11.4% in 2003.

- Swine Flu (H1N1): H1N1 emerged in the spring of 2009 and lasted until late 2010. This was the second recorded H1N1 strain. The first, appearing in 1918 and lasting through 1920, was referred to as the Spanish Flu. The 2009 iteration is believed to have infected 11–21% of the global population and caused between 150,000 and 575,000 fatalities. The death rate was approximately 0.03%. This pandemic occurred in the aftermath of the 2008 financial housing meltdown. For the full year 2009, sales declined -21.8% over the previous year. The decline is mostly attributed to the financial crisis and not to the flu outbreak.

- Middle East Respiratory Syndrome (MERS-CoV): Saudi Arabia recorded the first case of this coronavirus in April 2012. The outbreak spread to 27 other countries, according to the World Health Organization (WHO), which confirmed 2,499 cases and 861 deaths — a fatality rate of about one in three. Approximately 80% of the cases occurred in Saudi Arabia. Two U.S. citizens, healthcare workers returning from employment in Saudi Arabia, tested positive and both recovered. MERS also had no effect on the connector industry. Connector sales were down -2.7% in 2012 due to other issues.

Other Black Swan Events and Connector Industry Impacts

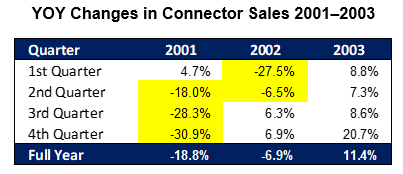

Dot-Com Bubble and September 11 Attacks (2001–2002): Connector industry sales declined -18.8% in 2001 and -6.9% in 2002. Prior to the financial crisis, this was the worst downturn in the connector industry since Bishop started tracking industry performance in 1980. The following table shows the industry’s year-over-year (YOY) performance by quarter during the 2001–2002 dot-com bubble crisis and September 11 attacks.

The downturn was severe — the worst ever in the industry’s history — and lasted six quarters. Following the downturn, the connector industry demand came back strong, growing +11.4% in 2003.

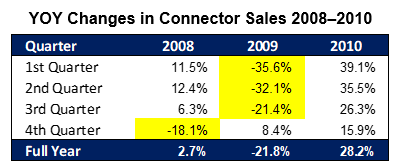

The Great Recession and H1N1 (2008–2009): The H1N1 pandemic had some measurable effect on the global economy; however, it paled in comparison to the financial crisis’s devastating impact. The following table shows connector industry sales performance by quarter from 2008 to 2009.

This downturn lasted only four quarters but produced the two worst quarters in connector industry history: 1Q09, which recorded a loss of -35.6% and 2Q09, which recorded a loss of -32.1%.

Connector Industry Outlook

As noted in this Bishop Report, February orders are up +3.5% and sales are up +0.7% year-to-date (YTD). Industry leadership has advised that the first two weeks in March resulted in strong order placement and created an order backlog. We believe that it is reasonably safe to forecast a less than disastrous first quarter 2020, despite the pandemic. In fact, 1Q20 could result in a modest improvement over 1Q19.

Other comments by industry leaders follow:

- Production in China is at 90% capacity.

- There is no supply-side problem. Connector inventories are ample. Any future slowdown will be demand-related.

- There are no connector pricing issues. Prices are stable.

- Lead times are normal and not expected to increase due to production problems. Should connector demand decline, lead times could shrink.

- Currently, order backlogs are solid with some (albeit minimal) double ordering and order push-outs. We will watch out for order cancellations and advise if we see a trend developing.

2Q20 Outlook and Beyond

No one knows with any certainty what will transpire in the second, third, and fourth quarters of 2020. Clearly, we are in uncharted territory with COVID-19. Basically, the world is on quarantine. Business activity has been drastically reduced and will not likely resume to full capacity until it is evident that the pandemic virus has run its course.

It is reasonably safe to assume that the COVID-19 crisis will not end during 2Q20 (i.e., by the end of June). As a result, 2Q20 most likely will be dismal. When Bishop staff was recently asked how connector sales will perform in the second quarter, opinions of those polled ranged from -10% to -30%. Obviously, we have no consensus as to what will happen in the second quarter. However, our expectations are for a significant downtown, possibly even greater than -30%. If the pandemic does come to an end within the second quarter (e.g., in the May/June timeframe), the second half of 2020 will rebound significantly. However, we believe that, on balance, it is realistic to expect that the 2020 connector sales decline will be one of modest proportions. COVID-19