Digital Transformation: Industrial IoT and the Connector Market

The Industrial Internet of Things (IIoT) has become a reality, and could very well be the biggest driver of productivity and growth over the next few decades. The smart grid, the most mature of the IIoT sectors, although still in its infancy, will drive the development of many new and improved connector technologies for years to come.

Following the first, second, and third industrial revolutions: mechanization, mass production, and automation, the fourth revolution has arrived on our doorsteps and is dubbed the Internet of Things (IoT). When it comes to IoT, there is no lack of media coverage these days. To some, the hype around the IoT is exaggerated, but there is no doubt that we are at the dawn of a digital transformation that will profoundly change our lives, including: the way we do things, manufacture things, and control all other aspects of our lives spanning medical care to mobility and communication.

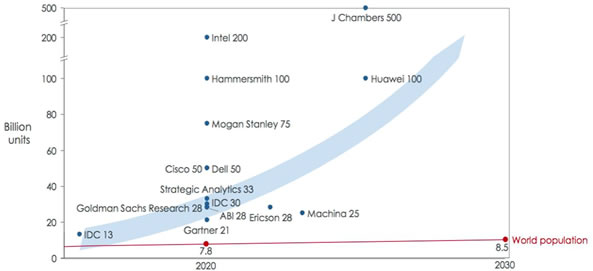

Nobody can accurately predict how many devices will eventually be connected. The graph in Figure 1 is based on such predictions made between 2014 and 2016 by various well-known industrial companies and research sources, and shows just how widespread these estimates are.

Figure 1: Various estimations of the number of connected devices in the IoT. (Image courtesy of PTC).

Although many like to speak about the IoT as the fourth revolution in our industry, the reality is — and most experts agree with this — that it is more of an evolution than a revolution. The technologies used throughout the Industrial IoT (IIoT) are not all necessarily new. Many of these technologies have just become easier to use and cheaper to purchase, implement, and maintain.

The primary catalysts for the exponential growth expected of the IoT include:

- Cost savings for Big Data:

- Big data collection (cost of sensors)

- Big data transmission (available bandwidth, especially when using fiber optic networks)

- Big data storage (cost of storage RAM/Flash/HDD and Cloud storage)

- Big data processing (cost of computing)

- Cost savings for hardware and software:

- Sensors

- Microprocessors

- Batteries and self-powered devices

- Connectivity and networking

- Cost savings for installation:

- Set-up (ease of use and configuration)

- Repair and maintenance (usually immediate module exchange)

- Interoperability (limited to a certain extent and depending on protocol used, etc.)

Logically, since we don’t know what the total number of connected devices will be (as evidenced by Figure 1), we can’t estimate the future potential for the connector market either. Further, an added complexity to accurately estimating the connector potential is that both various market sectors and various technologies and products used in industrial, medical, automotive, telecom, and consumer applications are starting to converge.

Sensor technology and communication are central to the implementation and rollout of the IoT. There are many different communication technologies and protocols developed and available that claim to be the best solution for any given application. There will be winners and losers in due time, but, at the moment, there are still many different options for wired and wireless connections. As a result, products are often equipped with more than one communication protocol. The best-known and most widespread communication protocols include:

- (Industrial) Ethernet

- AS-i bus

- CAN bus

- RFID

- Bluetooth

- WiFi

- LoRaWAN

- ZigBee

- BACnet

- DALI

- KNX

- Z-Wave

- NFC

- Cellular (3G/4G/5G)

In an attempt to differentiate between all of these IoT applications, we prefer to talk about the Industrial Internet of Things (IIoT) when we apply IoT principles to industrial manufacturing and production, the process industry, and other industrial markets, including: the energy market, mining sector, and civil engineering markets. To get a better grip on this market sector, Bishop & Associates divided the Industrial IoT (IIoT) market into three different segments that are closely aligned with our current market sector breakdown for connectors:

- Smart Factory: This market includes products that are used in a connected factory, i.e., a factory that is making the transition from a conventional standalone factory to a factory that is part of the IIoT ecosystem.

- Smart Grid: This market refers to the current transformation in the energy market as electrical networks and grids are upgraded and automated. Using Big Data and control algorithms, energy supply and demand are linked together and used more efficiently in smart grids than in conventional grids.

- Smart Cities: This market includes IoT-enabled equipment used in modern buildings and homes to control temperature, HVAC, air quality, doors and windows, lighting, and security devices, among others. When connected to the Internet, users can control such equipment remotely, often via smartphones and tablets. To a certain extent, this market also covers Smart Lighting, Smart Parking, and Smart Traffic.

Smart Factory

Automation in factories, and especially within the automotive sector, has already reached impressive levels. Industrial robots sales are booming and factory networking and automation have been advancing for at least two decades. Adding the Internet of Things into the mix will offer the manufacturing and process industry opportunities to take these advancements to the next level. Today, we are quite good at descriptive analytics and diagnostic analysis; however, with the IIoT, we can move to predictive analysis and even preventive analysis, as the IIoT ecosystem will be able to imply what will happen next and how to best improve results.

Some of the key drivers in the evolution of smart factories are:

- Extensive use of robotics and industrial robots working with and alongside humans

- Machine-to-machine communication (M2M) everywhere

- Implementation of Cyber-Physical Systems (CPS)

- Inclusion in manufacturing processes of 3D additive printing

- Inclusion in manufacturing processes of augmented reality (AR)

The main objectives of integrating IIoT into smart factories are achieving higher levels of efficiency and customer satisfaction (mass customization), as well as the most cost effective use of resources, and minimizing disruptions.

Smart Grid

Smart grid is the term coined for a new approach that significantly increases the efficiency of the entire electrical delivery system and guarantees an improved electricity supply chain that runs from multiple power plants all the way to the point of consumption. Its aim is to increase the reliability of the entire system, as well as to reduce the environmental impact of energy generation and consumption.

The smart grid is one of the more advanced smart market sectors in terms of IIoT products and services. Millions of smart meters have been installed in millions of households around the globe. Most developed countries have started to modernize their electrical grid to facilitate automated digital communication technology to collect real-time data about the status of the network with regard to supply and demand. This collection of (big) data provides smart grids with the capacity to maximize the throughput and reliability of the electrical network and improve overall energy efficiency. Smart grids will be connected to each other (and cross-border as well) to make the systems even more efficient and increase redundancy in case of emergencies.

Industrial grid systems and products, which are often more complex than those designed for domestic use, are also being developed, implemented, and connected to the main smart grid. Market players such as Grid Solutions (GE/Alstom) and ABB expect further huge investments in this market over the next few decades.

Another key element in the smart grid market is energy storage. The market for energy storage products is booming, and new innovations in this segment have the potential to be highly profitable.

Smart grid market drivers include:

- Improved electrical grid reliability, efficiency, and security

- Reduction in overall energy costs

- Reduced CO2 emissions (to meet internationally agreed-upon levels)

- Ability to connect a variety of energy sources (e.g., fossil fuels, wind, solar, hydro) to the grid

Thus, this market is driven by both the private sector and the public sector.

Smart Cities

A smart city can be described as an interconnected city where commercial and residential buildings, infrastructure (e.g., road, rail, sea, and air), communication networks, public transport and services, energy systems, waste treatment, water supplies, air quality, and so on are all interconnected and capable of acting on Big Data collected from all the connected “things” and stored in cloud applications. These applications can provide output that initiates actions either autonomously or with/after human intervention. As such, smart cities are also connected to the smart grid, facilitate smart traffic, and help contribute to the success of smart factories.

As modern cities try to cope with an expanding population at a time when natural resources are being depleted at an increased rate, urban planners need to address some key issues:

- Energy efficiency and management

- Communication and connectivity

- Safety and security

- Traffic infrastructure and logistics

- Water and waste treatment

Many of these issues can be addressed through the application of the IoT to a range of sectors designed to lead to smarter cities, such as:

- Smart buildings and homes

- Smart traffic

- Smart lighting

- Smart parking

- Smart water

Although many (mostly pilot) projects are currently underway, legacy systems and infrastructure, legislation, and financial and other resources will all pose limits on the speed at which the smart cities can be realized and systems can be rolled out. The real bonanza in this market may not occur before 2020 – 2025.

Connector Sales

Based on our analysis, the resulting potential for connectors in the Industrial IoT (IIoT) market already reached $2.266 billion in 2015, or 4.4% of the global connector market, and this share is expected to grow to 5.1% in 2021. Connector sales into the IIoT are hard to quantify because the IIoT is not clearly defined along unambiguous borders. As such, the calculated potential does not represent the total industrial market for connectors, but rather the additional potential driven by the IIoT.

Figure 2: IIoT Connector Market Share by Segment, 2016

While the IIoT is rapidly becoming a reality, with many pilot projects being launched all over the globe, we are still at the early stages of its growth curve, and it’s important to recognize that the accelerated growth of these markets is still ahead of us.

The smart grid market is probably the most mature of the IIoT market sectors we identified in this article. This estimation is illustrated by the pie chart in Figure 2, which shows that the smart grid market comprises 56% of current (2016-) connector sales in IIoT markets. Due to the fact that the smart grid is further up the lifecycle and maturity scale, its five-year compound annual growth rate (CAGR) is lower than the CAGR for the industrial smart factory market and the industrial smart city sector.

For more information about the Industrial Internet of Things, please refer to our newly released report, “Digital Transformation – Industrial IoT and the Connector Market.”

Recently posted:

[related_posts limit=”10″]

- The Industrial Market for Connectors in a Changing World - April 20, 2021

- How Key Trends in the Transportation Market Will Impact Electronics Growth - March 17, 2020

- Automation Means a Bright Forecast for Industrial Connectors - February 19, 2019