Alternative-Energy Vehicles: Standards, Enabling Technologies, and Market Predictions

Eric Liu, a chief engineer at JONHON, discusses standards, enabling technologies, and market predictions for alternative-energy vehicles in China and beyond.

Eric Liu, Chief Engineer, JONHON

New Energy Vehicle Standards

BYD Electric Buses (Image courtesy of DKMcLaren)

Design developments related to electric vehicles are expanding rapidly. Although the world’s major automotive companies use various means to promote the development of alternative-energy vehicles, development has to prioritize policy guidelines. These products and methodologies are not yet mature and well defined. Alternative-energy automotive OEMs and upstream supporting manufacturers need to pay attention to the industry dynamics and familiarize themselves with the industry’s needs in order to accurately define their own development requirements.

At present, this industry segment lacks unified technical standards. Although the alternative-energy automobile industry in China is in the throes of a significant development opportunity, and has already drafted some electric car technology standards, they are not sufficient enough for continued advancement. Technical standards are based on market competition, so countries and major automobile manufacturers around the world are currently trying to establish their own technical standards monopoly in hopes of dominating the future-energy automobile market.

Due to the absence of unified standards, the procedures for selecting products and defining performance parameters for electric vehicles is less than perfect. Additionally, the speed with which product updates iterations hit the market is excessively high, which is creating great risk for the industry’s technology and market development. In response, component manufacturers and other supporting manufacturers in the industry need to focus on the developing standards and adjust their corresponding development schemes.

Onboard Interconnect Systems

The onboard interconnect systems of alternative-energy vehicles can be divided into two categories: connectors and cable assemblies and auxiliary source control systems (e.g., integrated equipment).

The main application scenarios for high-voltage electrical connectors in alternative-energy vehicles include: DC and AC charging ports, motors, high-voltage wiring harnesses, maintenance switches, inverters, batteries, high-pressure systems, and air conditioners.

Figure 1: JONHON’s HVIL Series connectors deliver robust and reliable high-voltage solutions for alternative-energy automotive applications.

The harsh environmental conditions in these applications can easily cause connector overheating or burning and signal interference, so the connectors designed into them should be ruggedized and sealed for stable performance. Alternative-energy vehicles need high-voltage connectors to be equipped with high-temperature resistant, high-performance material and for their waterproof seals and shielding mechanisms to be more robust than traditional car connectors. As such, the cost for these connectors tends to be higher than general automotive industrial connectors.

In the passenger car market, a developing design trend is to integrate motor driven controllers with the motor, power distribution units (PDUs), DC/DC systems, and onboard computers (OBCs). These integrated systems can be a liquid-cooled triad or duo for two-in-one products like combination PDUs and OBCs.

In the bus market, there are two primary developing trends at present. One is the integration of all high-voltage equipment, including motor driven controllers, and another is the integration of auxiliary controllers in addition to motor controllers, which integrate PDU, DC/DC, and DC/AC products with liquid- or air-cooling systems that can be designed according to customers’ requests.

With the gradual improvement of cost requirements, auxiliary source integrated controllers have become the main trend in the present market; although, distribution boxes still have large markets in short-term projects. The requirements for distribution boxes have also improved with regard to miniaturization, cost, and capabilities. Since customers continually demand smaller sizes, the outline shape for distribution boxes is now adjusted to special designs according to specific vehicle requirements. Costs are also being reduced thanks to the migration of core components into high-reliability domestic products, but must continue to be controlled more strictly and with consideration to the whole production process to reduce costs as far as possible. Additionally, distribution boxes now offer intelligent features that allow them to automatically detect and control the working status of internal devices at any time.

Charging Products and Facilities

Direct current (DC) electric vehicle charging piles are commonly known as quick chargers. They are affixed outside of electric vehicles, are connected to vehicles’ AC power networks, and can provide a DC power supply for vehicles’ mounted electric batteries. The input voltage of a DC charging pile using a three-phase, four-wire power supply at 380VAC at 50HZ can provide enough output power to charge the battery and has a wide adjustment range for both the output voltage and current, which satisfies quick charge requirements.

Alternating current (AC) electric vehicle charging piles are commonly known as slow charge. They are affixed outside the electric vehicle, are connected with an AC power network, and can provide an AC power supply for the electric vehicle charger. AC charging piles only provide power output — they do not have a charging function — so they need to connect to the car charger for electric vehicle charging in order to control the power supply.

China’s alternative-energy vehicle charging facilities market is still in the exploratory stage. However, the business model is faced with limited profit space, fierce competition, the need for homogeneity, and a broad future, so the industry is expected to mature soon.

In order to better seize the charging facilities market, some manufacturers are designing new charging equipment, as well as building and operating charging facilities. The current business model for charging service alone projects that it will take five to seven years to recover the cost. So, many charging facility operators are actively branching into other areas, including the lease and sale of alternative-energy vehicles, parking spaces, advertising, and automotive data.

Influenced by the rapid growth of the alternative-energy automobile market, the charging infrastructure market is beginning to lean toward decentralized charging piles. Since centralized station construction requires both land and power, they are often built in outlying areas of the city, resulting in high investments with low usage compared to the distributed charging piles located at universities, shopping malls, and residential areas that are generally more convenient for alternative-energy car owners.

Developments in Charging Technology

A variety of new charging equipment is being developed for rapid power charging, and with a diversity of charging methods. New charging technology currently in the research stage includes: 400A high-power charging, pantograph high-power charging, wireless charging, liquid-cooled charging, and laser charging.

400A High-Power Charging: In order to improve users’ experience with alternative-energy vehicles, design engineers are working to reduce charging times to the roughly five minutes that traditional vehicles take to refuel. Tesla, BMW, and other well-known car companies have proposed a 6C, 10-minute fast charging concept. Such systems would require charging power equipment with 360kW capabilities and, in order to improve the bearing capacity of the charging interface, would require cooling fluid in the charging gun.

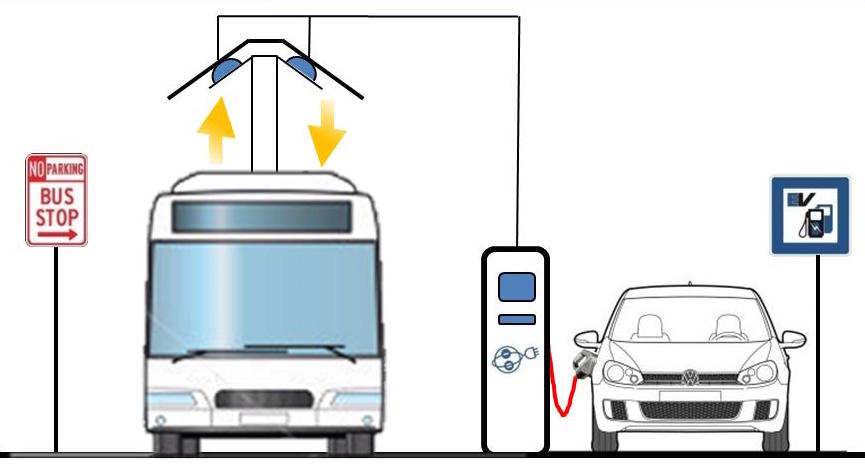

Pantograph High-Power Charging: Large electric buses that make multiple daily trips need to be able to charge in the 10 or so minutes that the buses stop at stations. This level of fast charging requires more than 1,000A of current, and even liquid-cooled conduction type charging guns cannot meet these requirements. So 500kW super power charging train pantographs are being used to meet these requirements.

Figure 2: Pantograph high-power charging technology is being used to fast-charge electric buses.

Wireless Charging: Wireless charging technology, also known as induction charging and non-contact inductive charging, uses near-field induction power supply equipment to transfer energy to utilization devices. These devices use the energy they receive to charge vehicle batteries, as well as for their own operation. Advantages of wireless charging include space savings and simple operation compared to conduction type charging. Downsides include low charging efficiency and high construction costs.

Liquid-Cooled Charging: Due to the dusty, sandy environment in northern China, internal charging equipment is generally covered with dust after one to two years of operation in the open air, which frequently leads to equipment failure. Currently, NARI Group Corporation and XJ Group Corporation lead the development of IP65 closed charging piles. These new charging piles remove the intake and outlet and instead use fluid to cool down the charging module and improve the service life of the product. Prototypes have been produced, but have not put into bulk use. The primary disadvantage of this charging technology is that it is very high cost at present.

Laser Charging: Lockheed Martin recently developed laser charging technology for the high-altitude charging of unmanned aerial vehicles (UAVs). With the aid of this new wireless charging, Lockheed Martin has successfully achieved more than 48 hours of flight time for UAVs. Laser charging can provide remote energy safely, with no interference due to high voltage, radio frequency fields, electromagnetic pulses, or strong magnetic fields. In response, a bus station in Geneva, Switzerland has added laser-enabled flash filling technology. Flash filling does not charge batteries to full, but does provide them with 5–10% of full charge of electricity in a very short time, which effectively ensures that flash-filled buses have enough power to reach the next station and top off their charge.

The early development of any industry has to weather various complications and incompatibilities on the road to unified standards development, and the electric car industry is no exception. Several different charging interface standards will exist in the global market for a long time, but, as the popularity of electric cars continues to rise, the industry will grow more and more concerned with the compatibility problems caused by diverse standards. So, even if the world can’t agree on a unified form factor for charging interfaces, the standards that govern charging infrastructure control modes and communication methods are very likely to eventually reach an agreement.

Charging systems are an indispensable technology for electric cars. As such, this industry will have to develop orderly, uniform charging interfaces, charging networks, and charging facilities before it can begin to realize its full potential. However, the rapid evolution of enabling technologies, including miniature, lightweight, and highly reliability interconnects, helps designers continue to grasp at the forefront of development and standardization.