The Industrial Market for Connectors in a Changing World

The pandemic, supply chain restructuring, changing energy sources, and industrial automation are among the factors that are shaping the outlook for the industrial market for connectors and the technologies that will drive it in the years to come.

During 2020, making accurate predictions about the impact of the COVID-19 pandemic on the world economy turned out to be a difficult exercise. Even today, with the vaccination roll-out well underway in many countries, it remains to be seen how effective these will be against variations of the virus and how long it will take before we all need to be re-vaccinated. This uncertainty makes it difficult to predict the future outlook and performance for many industries, including the industrial market.

Apart from these considerations, there are other, less visible consequences of the pandemic. For example, how has and how will the COVID-19 pandemic influence our global supply chains? How will it affect our industries? And, as a result of all this, how will it affect the industrial market for connectors? In order to find out, we need to take a closer look at the manufacturing industry and energy sectors.

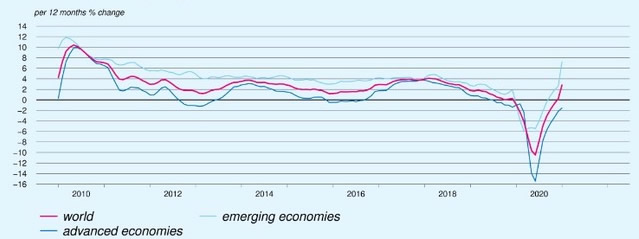

When we go back to the third quarter of 2020, the first surprise was that, after industrial production took a nosedive earlier in the year, the recovery was strong. Before the year was over, production output was back at 2019 levels. Instead of a long, drawn-out recovery, it turned out to be, at least for now, a V-shaped recovery. Global connector sales even broke records in Q42020.

World Industrial Production 2010-2020

Bishop & Associates believes the connector sales growth experienced in 2020 largely came from a shift in demand, as societies around the world turned their focus away from services (dining out, travel, etc.) and instead focused on consumption of consumer goods (laptops, tablets, and white goods). Students and workers required new equipment as their schools and offices shut down and hospitals required additional equipment to treat the influx of COVID-19 patients. These conditions persist in many regions. Additional shifts came from a rise in demand for bandwidth capacity as more devices came online, requiring buildouts of server infrastructure. All of these conditions resulted in a skyrocketing demand for electronic components, as is clearly illustrated in the growth we have seen in the connector industry since mid-2020.

These trends favor the computer and telecom/datacom sectors and do not necessarily boost all industrial markets. It is also important, however, to recognize there were already some megatrends shaping the manufacturing and energy sectors before the pandemic. These key trends include:

- Digital transformation of the manufacturing industry, most notably the implementation of IIoT and Industry 4.0

- Focus on energy consumption and a shift to cleaner, renewable, energy sources

- Re-shoring of manufacturing (research from MIT Sloan School of Management and others indicate that some companies are restructuring their supply chains to get closer to the customer)

If the pandemic did anything to the manufacturing industry — apart from disrupting it in the immediate short-term — it has probably accelerated the implementation of these megatrends.

Digital transformation enables companies to improve their productivity and become more competitive, which will also allow them to shorten their supply chains and create regional production centers to serve regional customers better — of course, with the added advantage that shorter supply chains are less prone to disruptions.

While some companies were already beginning to shift their supply chains from global to regional structures, effectively optimizing them on a global scale to bring production facilities closer to the end user, the need to do this became more apparent during the pandemic. Shorter supply chains are more robust and positioning production closer to the point of consumption (closer to the customer) brings the advantage of being able to adapt quickly to changes in the market and customer demand, and to better anticipate changes in the industry’s cost structures. The international competition we witnessed during the COVID-19 pandemic for medical equipment, vaccines, and other resources only reinforced the need and the thinking that supply chains better be short (i.e. preferably domestic) and manageable. When re-shoring — or in the other direction, offshoring —several important elements are usually taken into consideration:

- Cost: Sectors with low labor costs and high logistics costs may bring production back home if the labor advantage in distant production areas is significantly reduced.

- Level of automation: Sectors that can increase productivity by means of advanced automation technologies are likely to bring production back home.

- Innovation and intellectual property: Sectors with relatively high R&D spending, particularly valuable intellectual property (IP) embedded within the manufacturing process, or significant patent applications may choose to manufacture at home to protect their IP.

- Product quality and safety: Sectors with stricter quality and safety regulations (e.g., food, drugs) are also unlikely to offshore production.

- Essential business designation: Businesses, sectors, or products officially designated as critical or essential by governmental authorities may not be allowed to offshore their production or certain parts of it. Military equipment would be a good example. Another example: Serum Institute of India (SII), based in Pune, is the world’s largest vaccine manufacturer, but the Indian government has restricted its exports, as there is a shortage of vaccines in India. Domestic need may outweigh obligations to service foreign customers.

- Environmental regulations: Criteria and costs to meet or exceed local emissions or pollution regulations may influence production location.

- Politics and geopolitical issues: As we have seen in many trade disputes and also during the COVID pandemic, political tensions, trade disputes, and national interests can play an important role in the decision-making process to re-shore businesses. This would include (tax) incentives by (local) governments to attract new investments and companies.

Finally, the trend to curb energy consumption and increase the use of cleaner and renewable energy sources is accelerating. Although most of our primary energy still comes from natural gas, petroleum, and coal, this trend is here to stay. The pandemic may have had a short-term positive impact on our energy consumption, but it may also have had a short-term reverse effect on our transition to cleaner energy sources, as the prices of fossil fuels were under severe pressure during 2020 due to the drop in demand. In the meantime, these prices have recovered to pre-pandemic levels (early 2021 crude oil was back at about $60/barrel), so the effect may be short-lived. If, however, supply chains become shorter and the volume of products being shipped back and forth around the globe (by sea, air, rail, road) decreases, the demand for fossil energy sources used for this activity may decrease, or at least slow.

While many are optimistic about the post-pandemic manufacturing industry, especially in the light of the exceptional revival in some sectors, others are less optimistic about the midterm effects. A recent report by CreditSafe said, “The manufacturing industry in the United States is standing at the precipice of severe negative impacts due to COVID-19 and many manufacturers could see a significant decrease in their revenue.” Specific industries most likely to be severely impacted (in the U.S.) include:

- Printing and publishing

- Miscellaneous manufacturing

- Industrial machinery and equipment

- Fabricated metal products

- Apparel and other textile products

Re-shoring and changing supply chains to adapt to a new situation is costly and will take time, and the above findings will probably not be limited to the U.S. This could potentially harm the existing manufacturing industry, but, as always, it will also offer new opportunities for those companies that can offer products and solutions that fit into emerging manufacturing strategies and supply chain solutions.

In January and February of 2021, Chinese industrial output surged in the pandemic rebound, with an increase of 35% versus the first two months of 2020 and +17% up from the same period in 2019. In the U.S., the situation is slightly different: After rising 1.5% in December, industrial production again contracted by -1.6% in January 2021. Recovery in the manufacturing industry is more fragile, but a successful vaccination strategy, combined with increased consumer spending, will boost industry here as well. As far as job creation is concerned, the U.S. is already doing very well. Europe will probably lag behind China and the U.S. The climb out of the pandemic for these countries is slow and so is the vaccination roll-out, which is probably the reason the European countries are struggling to exit from the pandemic. Some industries, like the German car industry, were doing quite well in the fourth quarter of 2020. As long as demand continues to be strong, from exports markets as well as domestic customers, the European manufacturing industry should rebound as well.

This is good news for the connector industry, and it is already reflected in the very strong booking and billings data Bishop & Associates has been tracking in the Bishop Report. It also means two other things: Connector manufacturers must, like everybody else, rethink their supply chains and production locations, and, again like everybody else, think about what it can mean for the connector industry when the digital transformation accelerates. As more new energy sources are integrated into the grid and smart cities and buildings become the norm, demand will expand for connectivity solutions. This is where we will find new opportunities and plenty of room for innovation and exciting new products.

What it means for the industrial market for connectors will be determined by many factors, not just how the pandemic plays out. We’ll see how stimulus packages contribute to economic recovery, to what extend digital transformation in the manufacturing sectors accelerate, how we reorganize our supply chains, and, last but not least, how consumption patterns will develop in the aftermath of the pandemic.

For 2021, we expect mid-single digit growth in the industrial market for connectors versus 2020. Over the next six-year period (from 2020 to 2026), we expect the industrial market for connectors to grow with a compound annual growth rate of +5.7%, which is just slightly below the global connector market growth rate.

For more detailed information on the industrial connector market, see Bishop & Associates new report The World Industrial Market for Connectors 2021.

No part of this article may be used without the permission of Bishop & Associates Inc. If you would like to receive additional news about the connector industry, register here. You may also contact us at [email protected] or by calling 630.443.2702.

Like this article? Check out our other Market Update and Industry Facts & Figures articles, our 2021 and 2020 Article Archives, and our Industrial Market Page.

- The Industrial Market for Connectors in a Changing World - April 20, 2021

- How Key Trends in the Transportation Market Will Impact Electronics Growth - March 17, 2020

- Automation Means a Bright Forecast for Industrial Connectors - February 19, 2019