ECIA Charts a Resilient Electronics Industry

We talk to ECIA’s chief analyst Dale Ford about how the electronics industry weathered a challenging year with success and how the lessons learned will impact the way it operates in the years ahead.

Dale Ford, chief analyst at the Electronic Components Industry Association (ECIA), described 2020 as an “unforgettable year.” If that’s one of the least negative descriptors you’ve heard about the past 12 months, that’s because the electronics industry actually weathered the challenges of 2020 pretty well. A year ago, as the connector industry gathered at the DesignCon conference in California, attendees were sharing concerns about a virus that was shutting down factories in China’s electronics manufacturing district, extending the Chinese New Year holiday closures, and stressing supply chains. As the magnitude of the global pandemic became clear in the following weeks, component sales plummeted in response to closures, quarantines, and shifts in demand. However, a rebound in sales quickly followed, as many parts of the electronics industry became participants in efforts to manage the pandemic and the new ways of working, learning, and living it brought to societies. By the end of the year, ECIA’s data showed that sales levels for 2020 will be fairly stable compared to 2019, with some sectors showing mild declines and others actually achieving growth. So how does ECIA’s outlook for 2021 look? January sales were strong, progress is being made in containing the pandemic, and connected technologies are redefining every market. We talked to Ford to learn more.

Dale Ford, chief analyst at the Electronic Components Industry Association (ECIA), described 2020 as an “unforgettable year.” If that’s one of the least negative descriptors you’ve heard about the past 12 months, that’s because the electronics industry actually weathered the challenges of 2020 pretty well. A year ago, as the connector industry gathered at the DesignCon conference in California, attendees were sharing concerns about a virus that was shutting down factories in China’s electronics manufacturing district, extending the Chinese New Year holiday closures, and stressing supply chains. As the magnitude of the global pandemic became clear in the following weeks, component sales plummeted in response to closures, quarantines, and shifts in demand. However, a rebound in sales quickly followed, as many parts of the electronics industry became participants in efforts to manage the pandemic and the new ways of working, learning, and living it brought to societies. By the end of the year, ECIA’s data showed that sales levels for 2020 will be fairly stable compared to 2019, with some sectors showing mild declines and others actually achieving growth. So how does ECIA’s outlook for 2021 look? January sales were strong, progress is being made in containing the pandemic, and connected technologies are redefining every market. We talked to Ford to learn more.

From the perspective of our industry, 2020 wasn’t necessarily a bad year. How did electronics remain resilient in such a turbulent year?

Our earliest expectations, when we saw this breaking out in China, were that we would run into grave difficulty with supply. Then, as the pandemic went global, concern shifted to demand for products and how that could become the big limiting factor. The leaders in growth have historically been smartphones, consumer electronics, and industrial electronics. The laggards were automotive and certain sectors in consumer. So, there was great concern that the economic impact would significantly undermine consumer purchases of electronics. I’ll take a U.S.-centric view, because our research is focused on the Americas. Here, you had direct intervention on an unprecedented scale to take economic relief actions, which dramatically increased the budget debt, and now we have continued negotiations for yet another round. When economists framed their outlooks, they placed a lot of their analysis on whether or not the government would come through with these efforts to address the economic crisis.

So, there was a downturn for a quarter. But then we saw a strong return to very decent growth rates. Economists say we will not return to the overall level of GDP until the end of 2021, into 22. Even though the growth rates look like a “V,” they don’t like to call this a V-shaped recovery, because they’re looking at absolute GDP value and a longer recovery period. On the other side, you had a shift in terms of where demand was being driven. A lot of spend at the corporate level, in terms of IT, infrastructure, things of that nature, shifted to spend on consumers needing to set up home offices or environments for remote learning. It went to the need to dramatically expand the capability on the cloud and to expanding bandwidth for communications. I recall in the early days of when this was taking place, the bandwidth that you had for trying to connect from home was a real problem. There are clearly actions taking place to improve access for communications to homes, whereas the prior emphasis had been on expanding bandwidth to businesses. That drove up the demand in the data processing space, especially in data centers and communications infrastructure. Those are some of the factors in what I call the whipsaw effect that we experienced this past year in the industry.

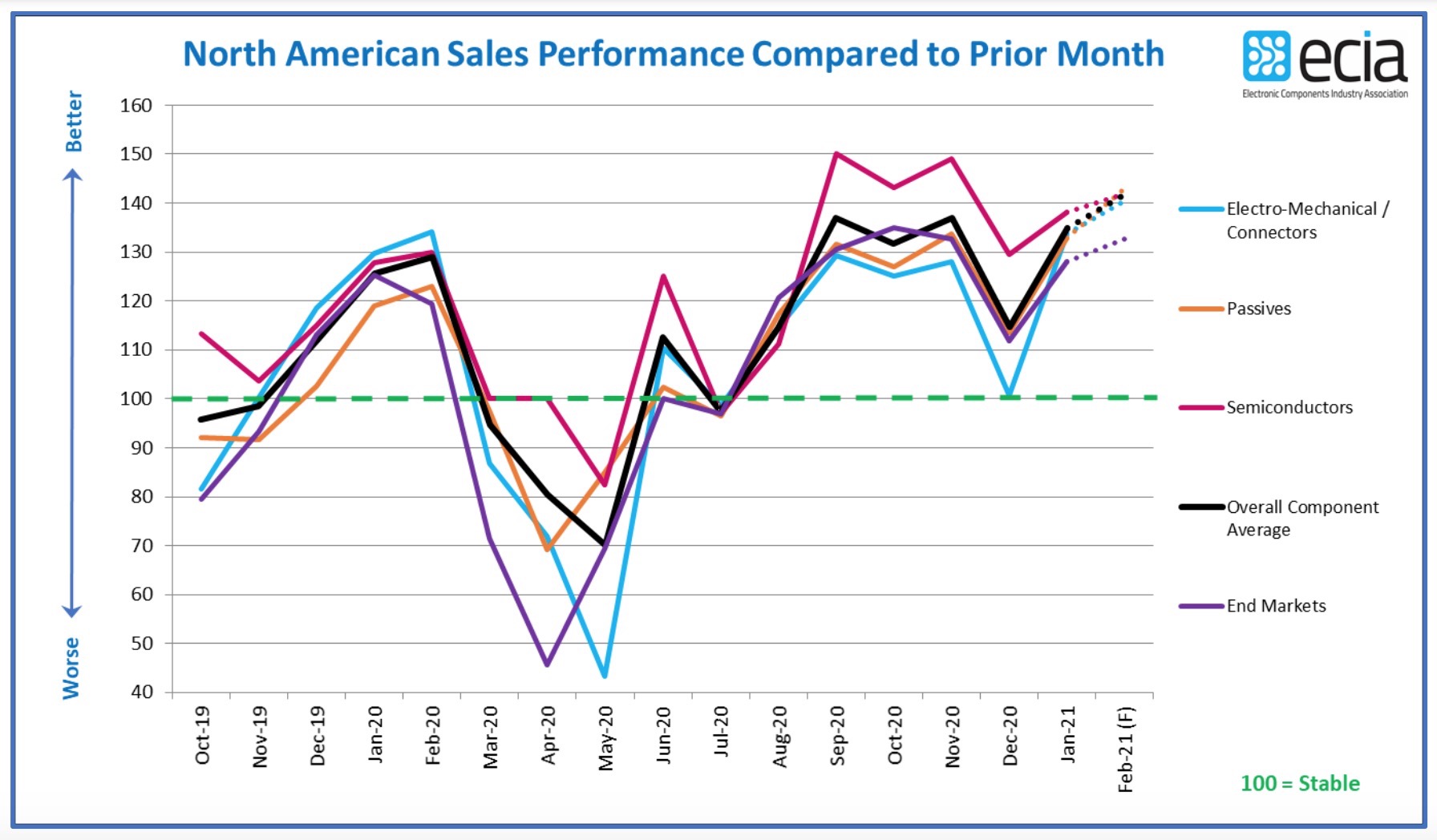

ECIA charted a brief dip in spring of 2020 as the electronics components industry absorbed the disruption of the COVID-19 pandemic.

Many companies have moved to a lean supply chain model. How does that impact their ability to serve customers when unexpected disruptions arise?

From prior growth cycles and supply chain crises, the semiconductor industry has applied significant learning to improve supply chain management and avoid bloated inventories during the good times. That creates real difficulties when you have a downturn and have to work off or write off those inventories in order to be able to achieve growth again. Now, the semiconductor supply chain has become quite agile in response to environmental changes. But the pendulum may have swung too far. That was reflected in the nervousness you saw at DesignCon. One industry leader that has been very prominent in addressing this is Lynn Torrel, the chief procurement officer and the chief supply chain officer at Flex. She was previously a top executive at Avnet and has made some excellent observations on this topic, one of which is that the electronics components industry has suffered from amnesia. We will experience a crisis in which supply chains are challenged and supply is limited and will respond by putting in stronger inventories, but then we forget and go back to the lean inventory model. Her hope is that this most recent crisis was strong enough, deep enough, and wide enough that we will overcome this tendency to amnesia. We need to ensure the strength of our supply chains and how we manage those inventories in light of the need to be better prepared for this type of crisis.

What has ECIA learned about efforts suppliers are making to decentralize manufacturing so that supply chains are less geographically concentrated?

When you bring your suppliers closer, you have an ability to improve your visibility and manage different crises. My analysis of import/export data was done back before the crisis; I did this in response to the tariffs that were imposed in 2019. I noticed that we’d already seen a shift out of China across the board in electronics components, much of that shift to other locations in Asia, such as Vietnam, Malaysia, etc. I believe this most recent crisis has accelerated that trend.

U.S. trade tensions with China remain unresolved. What changes do you hope to see occur in 2021?

There has been concern for some time about our relationship with China on a number of fronts, including concern about intellectual property and global competitiveness. There are now discussions circulating inside the current administration about establishing a bifurcation in terms of how we manage technology between the U.S. and China to address those concerns. That won’t happen overnight, because you have to set up networks, ecosystems, and technologies to do all this. But I think you’re going to continue to see a trend in that direction.

If you look at general comments, not just in the electronics industry, but in the manufacturing industry and different industry bodies, there is a desire for relief from the tariffs. That’s no secret. There is a desire to reestablish a trade environment that can yield the types of benefits that we experienced before, because frankly, the electronics industry was one of the biggest beneficiaries of the free, open trade environment that we’ve had for the past two decades. I’m not saying the industry wants to go back to exactly how things were before, because we want to protect intellectual property. We want to be able to compete on a global stage. And yes, we recognize that there are some abuses that took place. But we’d like to find some way to negotiate trade agreements that could be implemented without continuing the tariffs. There may be an opportunity to revisit things and pursue different solutions with the new administration coming in. I think China is anxious to reengage with the new administration, and hopefully that means that there will be flexibility on both sides, but certainly everybody would like relief from the tariffs. That process will bring its own challenges, including how to unwind those tariffs in terms of crediting customers, suppliers, and various partners up and down the supply chain. But I think you can certainly sense a desire in the industry for those tariffs to come to an end.

In terms of onshoring or reshoring, some companies are opening new manufacturing facilities in North America. However, the pandemic is accelerating the trend towards automation. Are we reshoring actual electronics jobs or is automation going to be the story of North American manufacturing?

It is a common concern that automation will impact the employment opportunities that exist in the electronics industry. And automation is happening. I have visited major distributor facilities, and a number of them had very impressive automation implementations already in place or in process. There’s been a significant degree of investment taking place in the distribution world with automation. But the thing they all pointed out was that their [education and skill] requirements for employees had grown with the automation. The way this was being implemented actually created more opportunities, and one of their greatest challenges was being able to recruit employees to meet the demand. Automation allows us to replace the more repetitive, monotonous, and dangerous types of functions and create positions with greater intrinsic satisfaction.

In terms of recruitment, what are you hearing from manufacturers, suppliers, and distributors about the challenges they face in filling their workplace requirements? How can the industry help educators develop the future workforce it needs?

As we bring people into our industry, there is a need for education orientation. You’re not going to just need people who have engineering degrees. You want a wider recruiting pool, individuals that don’t necessarily come with an electronics background. That’s an area where ECIA is very much engaged in providing industry support. We are working to develop educational solutions that companies can use to help their employees learn about the ABCs, you might say, of electronics: What is a semiconductor? What is a capacitor? What are the elements of a supply chain?

Another dimension is highlighted in a recent ECIA podcast interview that David Loftus, our CEO, did with Michael Knight, president of the TTI Semiconductor Group and senior vice president of Corporate Business Development at TTI, Inc. They discussed the role of sales and how, during the current crisis, the traditional way we perform the sales function had to change. We went to a virtual environment and we’ve learned a lot from doing things remotely, virtually. Knight mentioned that, in their company, they’re looking at how do things in the future, and how there will likely be some rebalancing of what you do onsite, on the road, and at home. I’m located outside of Sacramento and we have seen a strong out-migration of employees from Silicon Valley to our area, as their companies have told them that they can work remotely on a permanent basis. But if you have a greater share of your workforce working remotely, you’re going to have to develop solutions to instill your company’s culture and values in the workforce. I’m especially concerned about young employees beginning their career. I think there are real issues to be addressed there.

In the December 2020 episode of the ECIA’s The Channel Channel podcast, ECIA President and CEO David Loftus (left) interviewed Michael Knight, president of the TTI Semiconductor Group and senior vice president of Corporate Business Development at TTI, Inc. (right), addressing topics including where the industry is headed post-COVID and and his personal journey through the crisis.

Most trade shows and conferences were cancelled or became digital events in 2020. What lasting impacts will this have on the electronics industry?

ECIA did a survey in the middle of 2020, in which we asked companies how their plans would change in the future in terms of supporting trade shows. A significant number of companies reoriented towards online activities. Now there will be a return to trade shows, but companies may be rebalancing their investments in other solutions. We did just go through the world’s largest trade show with the Consumer Electronics Show (CES). When I would go to CES in person, most of my time would be spent on the show floor, having hands-on, direct interaction in a visual, tactile environment. I would spend very little time in the conference presentations. In the online CES, I found that it was much easier, and in some ways a more productive use of my time, to listen to the prepared presentations. Companies had some very innovative approaches, but it just simply was not the same as being there in person. When you go to CES, there is so much going on, there is no possible way that that you could take it all in. The real benefit of this last show was that, although it was still more than you could do in the few days of the live presentations, CES made the presentations and materials available beyond the show [through February 15]. So, there’s an opportunity to learn and look at things that you couldn’t do in the limited onsite timeframe. I hope that’s something they will continue in the future.

Did you see anything new at CES that you believe will be transformative in the future?

I’ve been discussing something for over three years now that I call the technology triumvirate. These technologies enable everything else, they form the foundation and are the critical drivers of growth going forward. That technology triumvirate is IoT, the cloud, and 5G. There are all kinds of other things at play — artificial intelligence, virtual reality, augmented reality, robotics — but they all have some dimension of that technology triumvirate playing a critical role in enabling the function and the advances that they will realize in the future.

How close are we to really feeling 5G’s impact?

The rollouts we’re seeing now are mainly pointed towards the smartphone platform and consumers. We’re deploying infrastructure and, just like we’ve done with every other wireless standard, we’re confusing our customers with all the variations of what we call 5G. Nevertheless, consumers are most interested in the most visible benefit of 5G, which is the higher bandwidth, lower latency benefits. 5G will have a much broader impact beyond consumer uses going forward; it’s been called the network of networks. Over time, we will see these benefits spreading into factory automation, fleet management, logistics management, inventory management, all kinds of uses. We will see a connected environment. The other factor that comes into play is cybersecurity. To deploy many applications, especially, for example, autonomous vehicle applications, you have to have bulletproof cybersecurity. And that is definitely not in place today.

Automotive had a tough year in 2020. As we see e-mobility adoption and connected car technologies grow, will automotive electronics rebound?

The number of electronic components per vehicle has already expanded dramatically, even without EVs or autonomous vehicles. That has made automotive one of the hottest sectors for us. In 2020, it took a hit because car shipments declined and the expansion of electronic components in automobiles was not enough to offset the decline in actual automotive automobile shipments. The good news is that we’re seeing automotive production return. The functionality enabled by electronic components and technology will expand in these vehicles, including new power management functions that come into play with electric vehicles. We have yet to see the true impact of IoT, 5G, and the cloud. But I think you’re going to see some exciting things happen over the next five years. However, that can be applied to the electronics industry overall, not just automotive.

Like this article? Check out our other Expert Insights, manufacturing, and forecast articles, our Consumer Electronics and Automotive Market Pages, and our 2021 and 2020 Article Archives.

- State of the Industry: 2022-2023 Connector Sales - April 16, 2024

- Amphenol is On a Roll - April 2, 2024

- Nicomatic Proves That Two Heads are Better Than One - March 26, 2024